Starting a business can be one of the most rewarding experiences in life, but also one of the most daunting and risky, particularly for small businesses. In 2018, there were 672,890 companies incorporated at Companies House but 508,865 were dissolved. If you’re planning to start your own business, the best way to increase your chances of success is to be well prepared. OnlineFilings™ have compiled this practical guide to setting up your limited company in 8 easy to follow steps to help you on your path to becoming a successful business.

1. Do your research

Having good business ideas are great, but for the best chance of success, you will need to do your market research. The key is to find out whether there is genuine demand for what you are selling, whether you are selling cakes, building services, consulting or are an online business.Have in mind who your target market is. Are you targeting individuals or companies? What is the age range of your ideal customer? Where are they located? Are they office workers?You can conduct market research by sending out surveys, speaking to friends, family and colleagues or even doing a ‘soft launch' to gauge demand for your products or services. You will also need to research what your competitors are doing - consider what their prices, quality of offering and location are.

2. Have a plan

All businesses require a plan if they are to be successful. A simple, effective business plan will include information about your target market, how you will reach you target market (marketing), what your Unique Selling Points are as well as the expected financials of your company. Failing to understand the financials of your business will make or break your company. The financials will include sales forecasts and expected cashflows in and out as well as costs.Sales forecast. You will need to have an idea of how much money you will make from sales A cashflow shows how much money is expected to come in and out of your business. Expected cashflows are made up of cash coming in (revenue) and cash going out (expenditure). Make a list of From this you can work out how much profit you expect to make - as with any business, profits are the key to successful operating business. Different types of business will have different costs associated. However, all companies will need some kind of investment to begin with. Your company may need business loans or start up loans to get started, and these are widely available with banks, building societies and through government schemes.

3. Choose a suitable business structure

You can trade either as a sole trader (or partnership) or a limited company. In general, it’s easy to set up as a sole trader and involves less administration, but a limited company is more tax efficient. There are pros and cons for both, and business owners should make the suitable choice based on their circumstances and business model. The table below shows the key differences between a sole trader and limited company:

You are the business | The business is a separate legal entity |

You are the owner | You are a shareholder; you hold all or a proportion of the company's share capital |

You need to file a Self-Assessment Tax return with HMRC each financial year | You need to file a Self-Assessment Tax return with HMRC each financial year as a company Director |

You are the manager or proprietor | You serve the company as its officer as a director (a company secretary is an officer too) |

You are personally responsible and liable for the business, including any losses or debts. | The Company is liable for losses and debts the company incurs. |

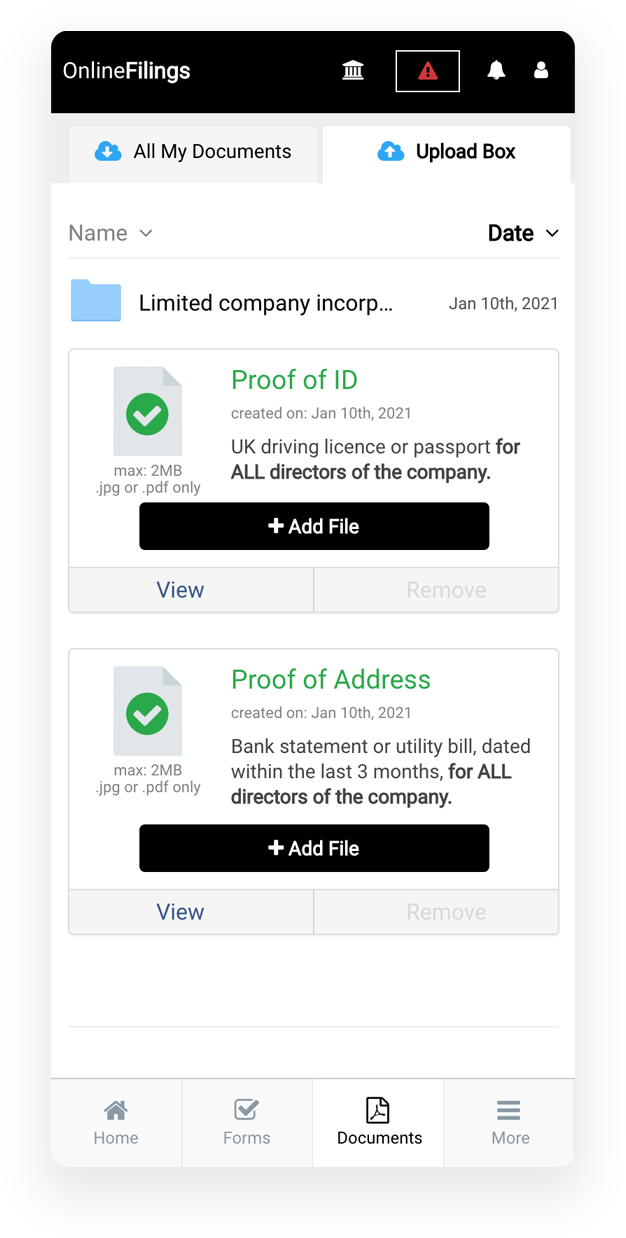

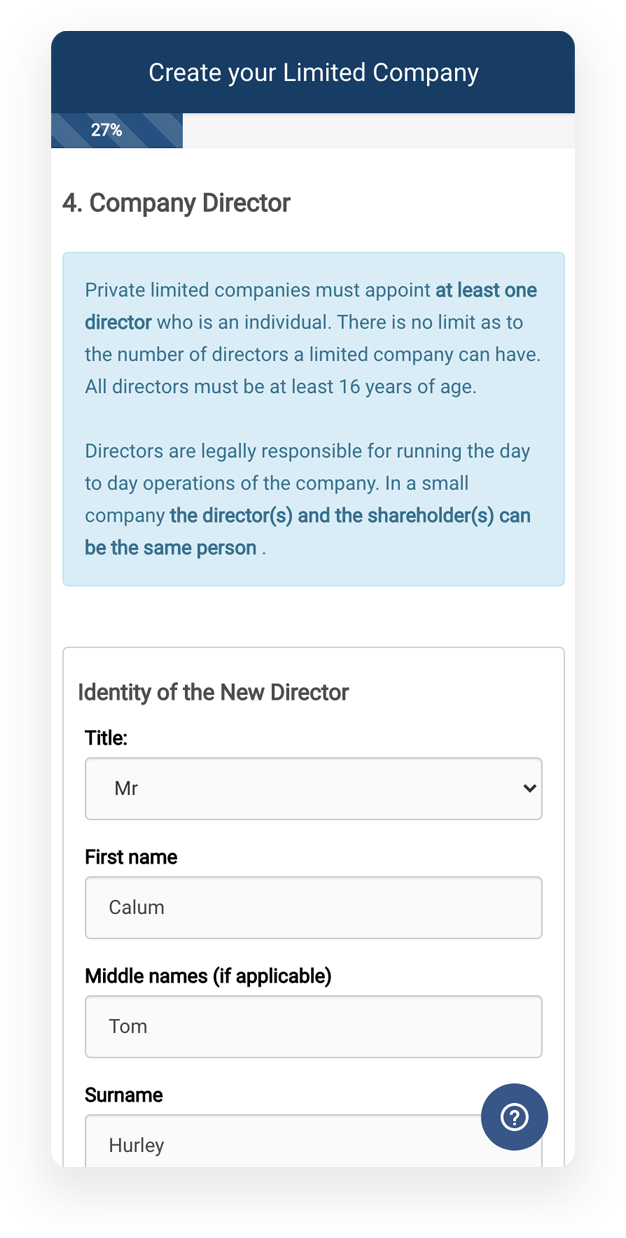

4. Company Incorporation

If you choose the limited company, you will then need to pick your name. You might want to check you can get a matching website address too. Using the search bar on the OnlineFilings™ homepage, you can check if the limited company you want is available to register. There are certain rules to choosing a company name and if your company includes a ‘sensitive name’ it may be rejected by Companies House (for more information, see our FAQ for limited companies).

Don’t forget to check you can get a matching website address too.

Once you’ve registered and have your Incorporation Certificate, there is more to do to make sure you meet all of the legal requirements as a director of the company.

UTR numbers

There are two Unique Tax Reference (UTR) numbers. One is your personal UTR which you need when you complete your Self-Assessment Tax return with HMRC. You will need to register and file your Self-Assessment if you are a Sole Trader or a director of a company, even if you are a basic rate taxpayer. The other is the Company UTR. HMRC will post a letter to your registered office address with your company’s Unique Taxpayer Reference (UTR) after incorporation. You will need this for paying Corporation Tax.

5. Business Charges

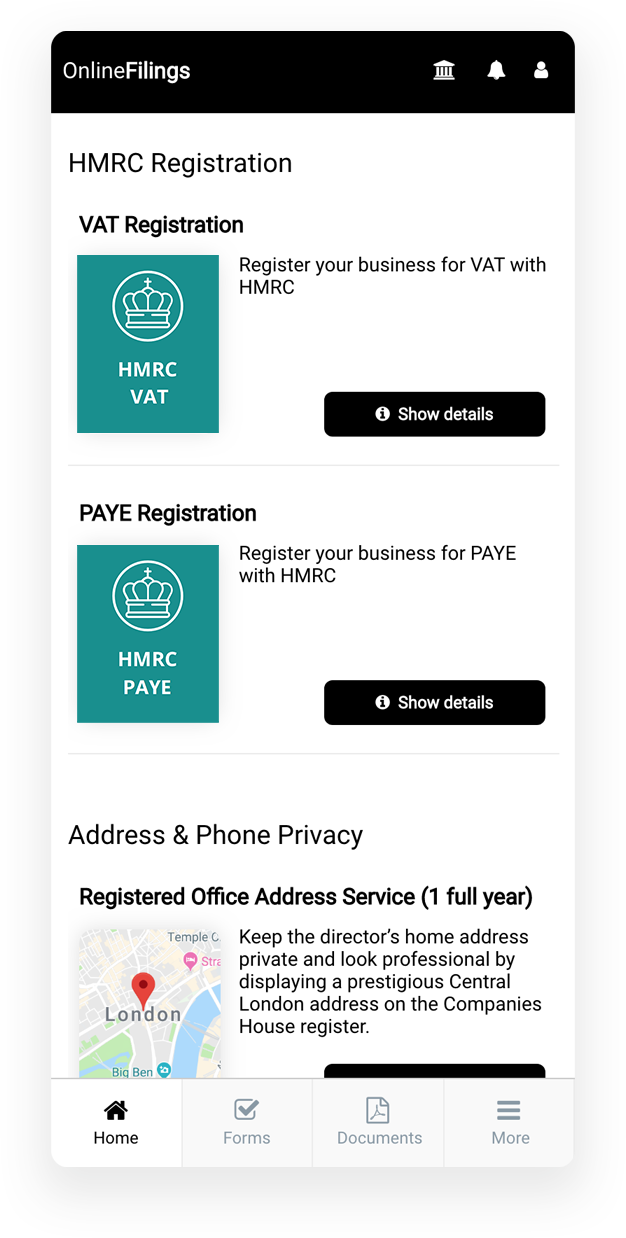

There are a number of business charges and taxes you need to be aware of when running your business.

Corporate Tax - your limited company will need to pay corporate taxes on its profits. As of 2019, this stands at 19% of profits and from 1 April 2020 will be set at 18%.

Pay As You Earn (PAYE)-If you intend to pay an employee (including yourself) more than £118, you will need to register for the Government’s PAYE scheme. Employees are assigned a tax code which will calculate how much you will need to take for income tax and National Insurance contributions when paying employees.

Value Added Tax (VAT) - If your revenues (sales) are likely to reach or go over the £85,000 turnover threshold on a 12 month basis, you are legally required to register for VAT with HMRC. However, even if you don’t hit the threshold, you might want to consider registering for the following reasons:

- If you register for VAT you will be able to claim back on the VAT for your expenditure from HMRC

- Some suppliers/customers could discriminate against your business if you are not VAT registered, affecting the growth of your company. Not being registered for VAT instantly informs a third party that your business is generating less than £85K per year and set a signal that your business might be too small for the job

Business Rates- if you have a physical business premises, you will have to pay business rates to your local council, for example for a coffee shop rental or office space. The rate depends on your local authority so you will need to check the rates before you sign the contract on your premises.

6. Set up business bank account

By law, the limited company is a separate legal entity, which in practice means that you will need to set up a separate business bank account. For sole traders, it is still best practice to keep your business finances separate from your personal finances. When setting up the account, be sure to take a copy of your company Incorporation Certificate to your meeting with the bank.

7. Start trading: notify HMRC

You need to pay Corporation Tax if you register as a limited company and need to notify HMRC within 3 months of starting to do business.

8. Insurance

There are a number of business insurance. The key ones are:

- Employer’s Liability-This protects you if an employee gets sick or is injured due to work. If you employ anyone, this is required by law, but if you are the only director and the only employee is you, it’s not required.

- Professional Indemnity-this is not compulsory, but if you provide professional advice, this protects you from legal action or if you make mistakes in your work.

- Public Liability-this covers injury to members of the public as a result of your business. It is not compulsory by law.

Once you have completed these steps, you should be well prepared and ready. Take the plunge and set up your limited company by clicking here.

Keep in mind that success doesn't happen overnight!