Connect

Connect

An exclusive marketplace of business services to supercharge your Limited company registration

1. Check your company name availability

Check instantly if your desired company name

is available. Select a company incorporation

package and option that's right for you.

2. Fill out our short application in 5min

Fill our simplified forms. Your company formation application is

submitted electronically to Companies House.

3. Receive your company registration #

Start trading in a few hours. Incorporation

documents are available in your online

dashboard as soon as your Company

Registration number is issued.

What is a Limited Company by Guarantee

Companies limited by guarantee are widely used for charities, community projects, clubs, societies and other similar bodies. Most guarantee companies are not-for-profit companies - that is, they do not distribute their profits to their members but either retain them within the company or use them for some other purpose.

Why set up a Limited Company by Guarantee

The main reason for a charity, community project, etc. to be a company limited by guarantee is to protect the people running the company from personal liability for the company's debts, just as a business may be set up as a company limited by shares for the same reason. Sometimes funding bodies, such as local authorities, insist on an organisation being registered as a company limited by guarantee.

Limited liability explained

If a charity, community project, club, etc. is not registered as a limited company, then the people running it (typically the management committee or a similar body) can be made personally liable for its unpaid debts. If the income does not meet these outgoings, the organisation may become insolvent, and the people running it (though not usually the members at large who are not on the committee) can be made personally liable for the shortfall.

In a company limited by guarantee, the liability is limited to the amount of the guarantee set out in the company's articles, which is typically just £1.

Limited Company by Guarantee members

In a company limited by guarantee, there are no shareholders, but the company must have one or more members. Subject to any special provisions in the company's articles, the members will be entitled to attend general meetings and vote, and in most companies that means they can appoint and remove the directors, and have ultimate control over the company.

Directors of a Limited Company by Guarantee

A company limited by guarantee, as a private company, must have at least one director. Most guarantee companies have several. They are responsible for the day to day running of the company

Limited Company by Guarantee ownership

As there are no shareholders, it is not possible to own a company limited by guarantee in the way that a company with a share capital is owned by its shareholders. The members of the guarantee company control it, in the same way as shareholders control a share company, but they do not have any shares or other security in the company that they can sell to another.

Online Filings offers entrepreneurs, professional expert advice and assistance to register a company and provide:

Professional Services

Online Filings is a Companies House authorised formation agent and approved filing and secretarial software provider. This means that we have developed our own incorporation software, approved by Companies House which securely sends all your information directly to Companies House.

Fast and Easy Process

We have simplified the formation process by creating a streamlined registration form. Our online digital assistant provides useful tips for a step by step support. Your limited company can be incorporated within a few hours and your new business bank account will be ready within days.

Lifetime Customer Support

Call, email or chat; we’re here for you. We provide help with added services after your confirmation statement has been filed.

1. Check your company name availability

Check instantly if your desired company name

is available. Select a company incorporation

package and option that's right for you.

2. Fill out our short application in 5min

Fill our simplified forms. Your company formation application is

submitted electronically to Companies House.

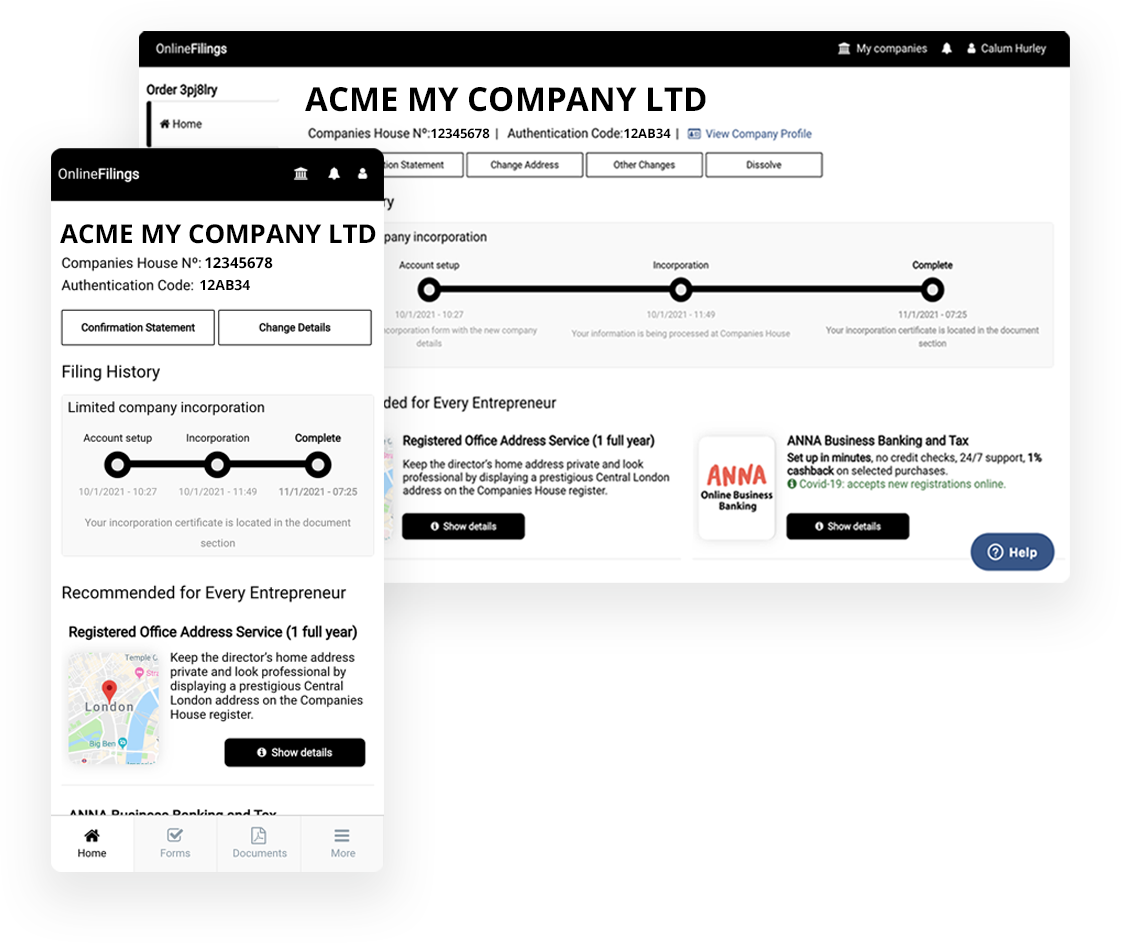

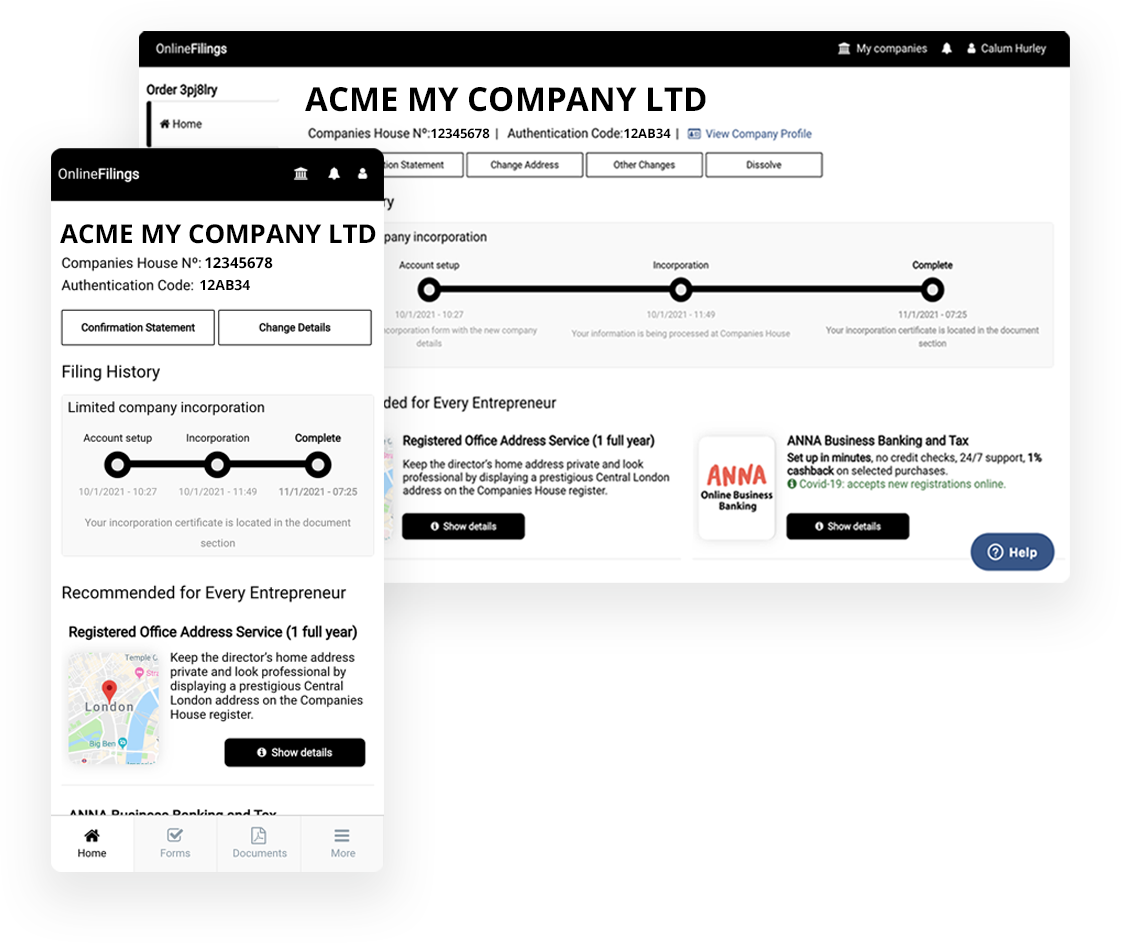

3. Receive your company registration #

Start trading in a few hours. Incorporation

documents are available in your online

dashboard as soon as your Company

Registration number is issued.

Same Day Processing

Most of our companies are formed within 3 to 6 working hours. In some cases it may take longer, subject to Companies House workload.

No Paperwork, Signatures or Documents Required

Our company formation process is 100% online, without the need for any paperwork, signatures or documents.

Turnkey Solution

Your new Company Limited by Shares will be fully approved by Companies House and ready to trade today.

Companies House Filing Fee Included

There are no hidden fees as Companies House fees for the incorporation of your company are included in all our packages.

What is required to set up a company?

To register a company limited by guarantee, you will need a suitable company name, at least one director and one guarantor (both of whom can be the same person) and an address for your company.

What are the annual requirements?

A Limited company must file annual tax returns ('corporation' tax returns) with HM Revenue and Customs.It must also file an annual return to Companies House, which is a snapshot of general information about the company.