You are a non UK resident and need a UK company ?

We'll set up your Limited Company with Companies House, you'll get your incorporation certificate

and start trading in a day.

We provide unlimited real human

support.

Connect

Connect

An exclusive marketplace of business services to supercharge your Limited company registration

1. Check Name Availability

Chosen a company name? Use our name search tool linked to the Companies House database to check if it's available.

2. Select a Package

Tailor your limited company setup: Add a virtual office, VAT registration, and more. All our company formation packages come with a 6-hour company registration turnaround.

3. Provide Your Details

Just provide the essentials for company registration: business activities, directors, and shareholder details. Focus on your business; we'll handle all the paperwork.

4. Officially in Business!

Your incorporation certificate will be emailed to you soon (and posted if you've opted in). Need help with admin? Just ask.

To incorporate a limited company by shares, you will need the following:

Once you’ve provided your information, it takes 1 business day to incorporate your business. Upon registration, we'll send you an electronic copy of your Incorporation Certificate, Memorandum and Articles of Association, Certificate of Good Standing and Share Certificates. Your printed company documents will be sent to you free of charge by DHL Express Worldwide Courier Service.

To incorporate your limited company as a non U.K. resident, you will need to provide:

Once we have received all your information, it will take just 1 business day to incorporate your company. It then takes 10 working days to receive your VAT registration number from Her Majesty Revenue & Customs (HMRC).

Banks will require company directors/shareholders to provide a UK proof of address. If you do not reside in the UK you won’t be able to provide the required proof of UK address. However, some banks may allow you to open an account if some of the company’s shareholder(s)/director(s) are resident in UK.

You can also decide to open the business bank account of the newly incorporated U.K. limited company in your home country (i.e. in a bank located outside the U.K). If your business is looking to open a bank account overseas, you may need to confirm the company details with your local bank and will be required to provide them with a certificate of good standing.

A third option includes opening an Electronic Money account (a legal institution that has been granted authorisation by the FCA to issue electronic money). Using an Electronic Money account is fairly similar to using a conventional business account. You can make payments to other business accounts and receiving payments from clients. You will also be issued an business account number and sort code as well as a banking card. The OnlineFilings platform has a partnership with Transferwise a leading Electronic Money and business account provider. Upon registration of your limited company, you will be contacted by them to open your business bank account.

Yes, every year, the company director(s) must file the following information:

You will be reminded of your filing duty at least 4 weeks before the due date and will be able to file directly via the OnlineFilings platform.

All official letters from HMRC or Companies House will be scanned and forwarded to you straight away free of charge to avoid delay. Any other mail that we receive for you or your company, wherever you are in the World, will be sent to you via Royal Mail. The cost of forwarding your non official mail will be taken from a £20 postage deposit - this is included in the package price. When this runs out we will ask you to top it up. General business mail will be forwarded at the cost of the Royal Mail postage plus a 15% handling fee.

No, by law Companies House requires using a U.K. correspondence address to register a UK business. This address is called the registered office address. Companies House will also require to know the residential address (home address) of the director(s)/shareholder(s) living outside of the UK. While the registered office address will be made public on Companies House register, the director(s)/shareholder(s) residential address will be kept private. Most companies which do not have a physical location in the U.K. to register the business at subscribe to the service of a registered office agent.

During the company incorporation process, Companies House requires that each director of the business must include their residential address (home address) and a service address. The service address is the address where directors receive all their statutory mails (official government mail from U.K. governing agencies, such as HMRC and Companies House).

The service address is listed on the public record at Companies House. The service address must be a UK-based address. The director(s)/shareholder(s) residential address will be protected information and is not available to the public (although it is available to some public authorities).

The OnlineFilings platforms company formation packages for non-U.K. residents include the director(s)/shareholder(s) service address.

The Non-Residents Package is a company formation package, and so it does not renew, however, there are renewable services within the package: the registered office and director address services as well as the Confirmation Statement service. If you choose to renew those services, the cost will be £221.00 plus VAT per year.

As part of the anti-money laundering regulation applicable in the U.K. You will need to provide a certified copy of your passport as well as a certified copy of a proof of address (water, electricity, landline bill) dated of less than 3 months. The process will start as soon as we have received a scanned copy of your certified documents by email.

Tools for every Limited Company in the UK

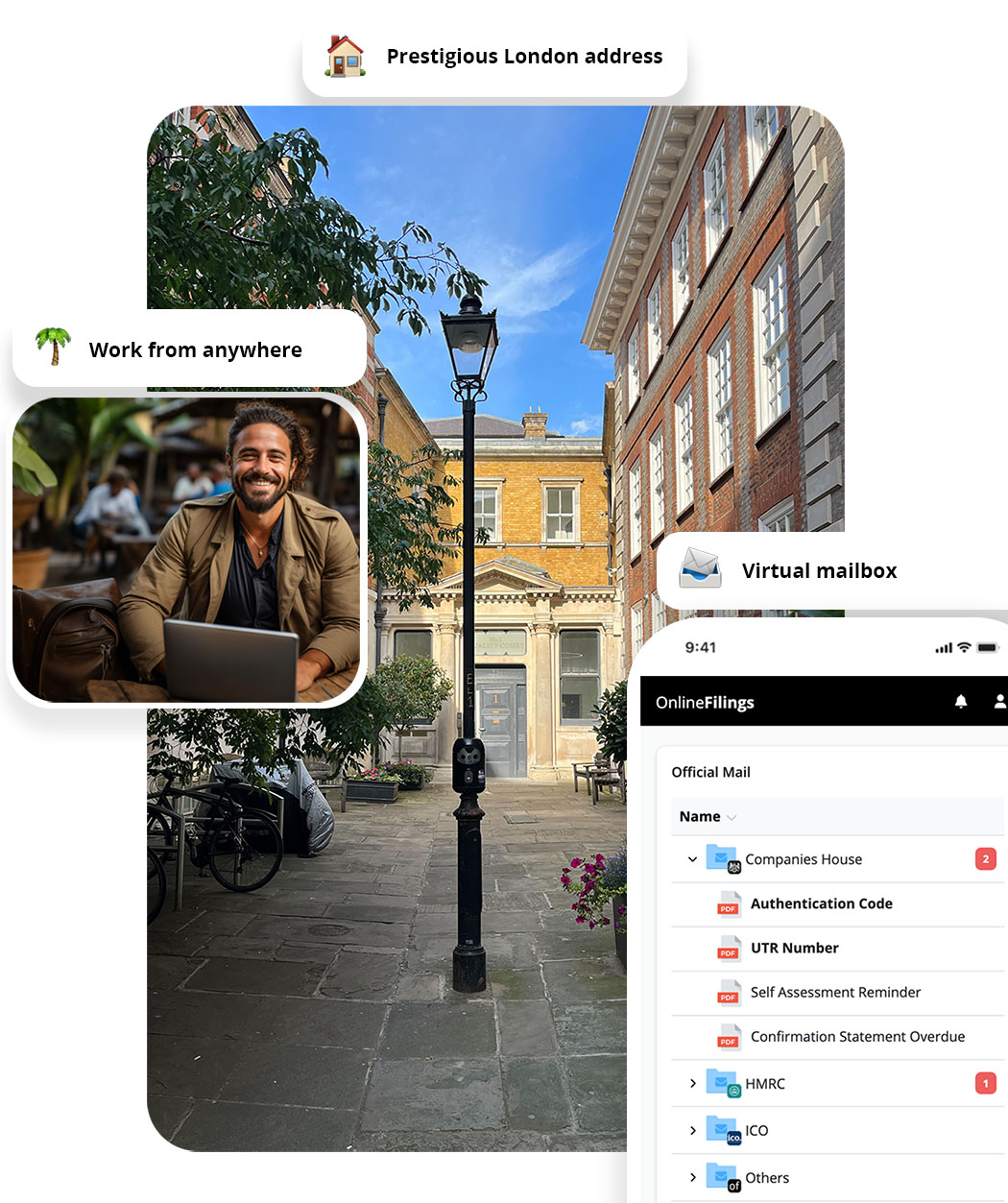

Secure your Privacy with your own Virtual Office

Prevent your home address from appearing publicly online, and on the Companies House Register.

Your official mail is saved, sorted out, and always available with our AI powered virtual mailbox.

The virtual office act as your official Registered Office Address, and director Service Address.

Bespoke UK Company Registration assistance

Get personal, unhurried support from our company registration experts. We're here to make you feel important and supported.

Growing something Good

Start a business, help the planet. We’re planting a tree for every company created with Online Filings, helping offset the estimated 25.8 million tonnes of CO2e emitted by UK small and medium-sized enterprises.