Connect

Connect

An exclusive marketplace of business services to supercharge your Limited company registration

1. Check Name Availability

Chosen a company name for your limited company? Use our name search tool linked to the Companies House database to check if it's available.

2. Select a Package

Tailor your limited company registration: Add a virtual office, VAT registration, and more. All our limited company registration packages come with a 6-hour company registration turnaround. Starting from £19.99.

3. Provide Your Details

Just provide the essentials to register a limited company: business activities, directors, and shareholder details. Focus on your business; we'll handle all the paperwork.

4. Officially in Business!

Your incorporation certificate will be emailed to you soon (and posted if you've opted in). Need help with your limited company? Just ask.

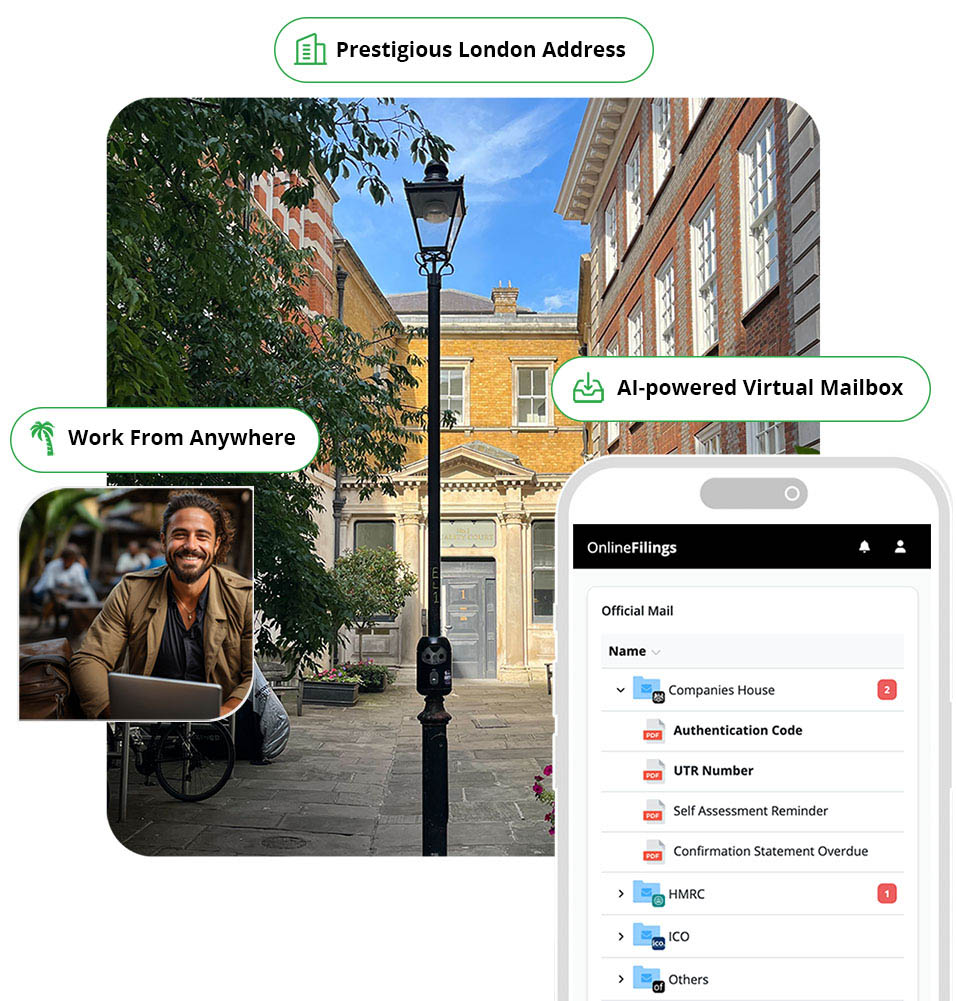

Secure your Privacy with your own Virtual Office

Prevent your home address from appearing publicly online, and on the Companies House Register.

Your official mail is saved, sorted out, and always available with our AI powered virtual mailbox.

The virtual office act as your official Registered Office Address, and director Service Address.

Bespoke Limited Company Registration assistance

Get personal, unhurried support from our company registration experts. We're here to make you feel important and supported.

Growing something Good

Start a business, help the planet. We’re planting a tree for every company created with Online Filings, helping offset the estimated 25.8 million tonnes of CO2e emitted by UK small and medium-sized enterprises.