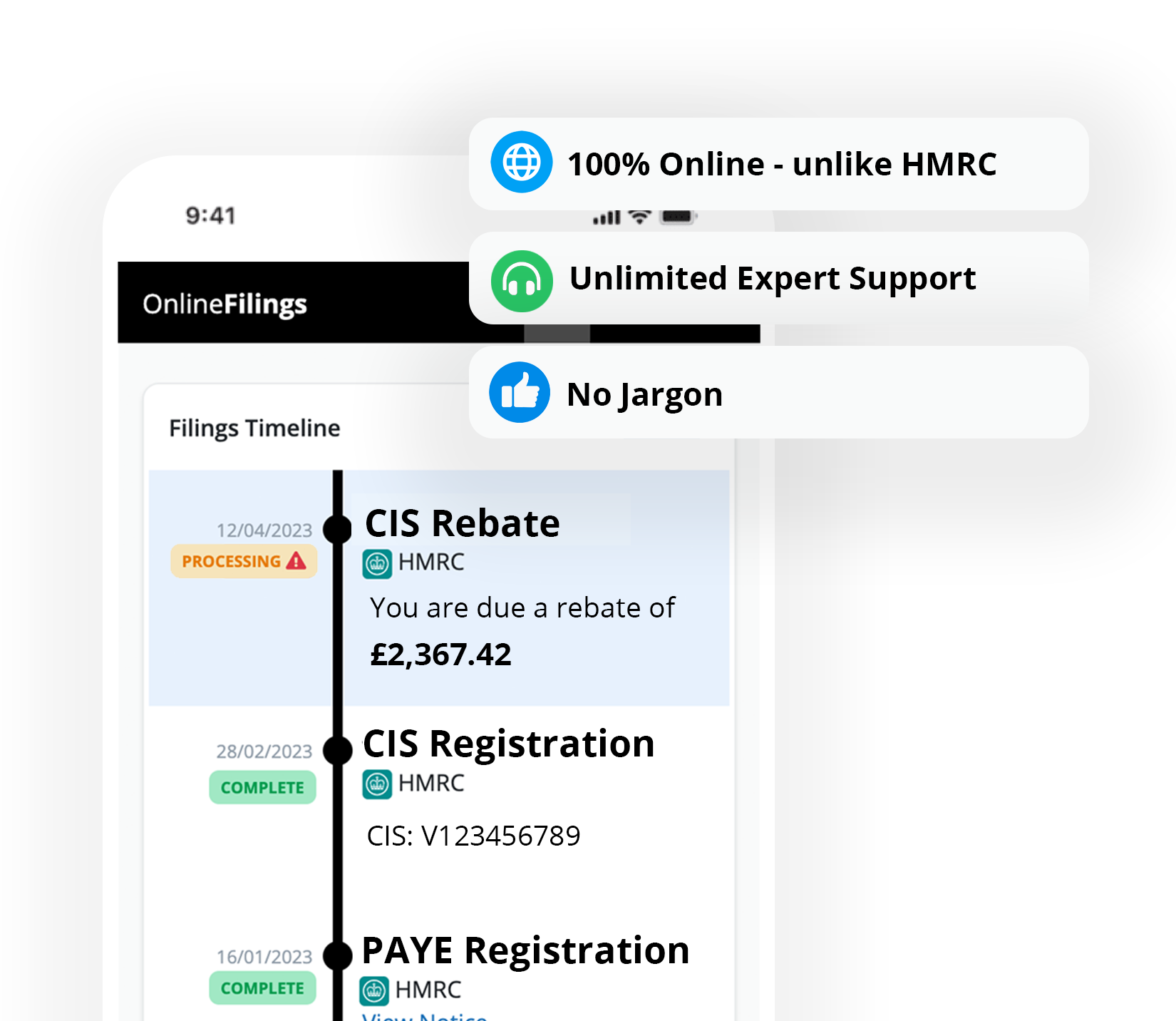

Take the stress out of CIS. We register your limited company or sole trader business for the Construction Industry Scheme (CIS). Simply provide a few quick details about you and your business – we’ll handle the rest.

Register for CIS

STEP 1:

Choose the registration type

Are you a contractor or a subcontractor? We have quick CIS registration for both.

STEP 2:

We handle the admin

Once you’ve filled out your application, we take care of the rest. Sit back and relax – we’ll let you know if we need any more details.

STEP 3:

Receive your references via post

Once HMRC has processed your application, you’ll receive a letter at your trading address via secure post.

We’re CIS registration experts

Let us handle your CIS rebates

Support whenever you need it

Compulsory doesn’t mean difficult.

Better cash flow, better reputation.

The all-in-one package.

The Construction Industry Scheme (CIS) covers a wide range of construction work including:

However, certain jobs that are exempt from CIS. These include architecture and surveying, carpet fitting, delivering materials, scaffolding hire (with no labour) and making materials used in construction including plant and machinery.

A CIS contractor is a business or individual who pays sub-contractors to carry out construction work.

A contractor is required to register under the Construction Industry Scheme (CIS):

Private householders, charity or trusts are not counted as contractors, so are not covered by the CIS scheme.

Under the CIS, contractors are responsible for deducting money from their sub-contractors' payments and paying it directly to HM Revenue and Customs (HMRC) as advance tax payments. CIS contractors are also required to file monthly returns with HMRC, reporting details of the payments they have made to their sub-contractors.

A CIS sub-contractor is a self-employed individual or a business carrying out construction work for a CIS-registered contractor.

Under CIS, sub-contractors have money deducted from their payments by the CIS registered contractor, which is then paid directly to HM Revenue and Customs (HMRC) as advance tax payments.

Deduction rates:

Sub-contractors must file annual tax returns with HMRC, reporting their income and expenses. The sub-contractor can claim credit for these deductions against their tax bill at the end of the tax year.

A CIS rebate is a refund of the Construction Industry Scheme (CIS) tax that you have overpaid to HMRC as a sub-contractor.

The refund amount is calculated based on the amount of tax that has been deducted from your payments by contractors, and the expenses that you have incurred in the course of your work.

If you are a self employed sub-contractor use our platform to calculate how much you can reclaim and file your tax return with HMRC!

As a self employed CIS sub-contractor, you can include various business expenses in your rebate claim, such as:

It's important to keep hold of all receipts and other accurate records of your expenses. This ensures that you can claim everything you're entitled to and avoid any discrepancies or issues with HMRC. According to HMRC, it is recommended that you keep your business records for at least 5 years after the 31st of January submission deadline of the relevant tax year.

Some expenses are not eligible for a CIS rebate. These include:

The CIS gross payment status is a CIS scheme designed for sub-contractors.

Once a sub-contractor has successfully applied for CIS Gross Payment status, the contractor will pay them in full without any tax deductions. However, sub-contractors will be responsible of paying Income Tax, National Insurance or Corporation Tax when filing their tax return.

Here are the main benefits of CIS Gross Payment Status for sub-contractors:

In order to apply for CIS Gross status under the Construction Industry Scheme (CIS), a business must meet certain turnover and compliance tests.

You’ll need to demonstrate that:

Your turnover for the last 12 months, excluding VAT and the cost of materials, must be at least:

If your company is controlled by 5 people or fewer, you must have an annual turnover of £30,000 for each of them.

The registration process for CIS can take 5-10 working days to complete. Once your application to register for CIS is approved, you will receive a confirmation letter from HMRC.