A collection of documentation that includes answers to frequently asked questions and how-to guides. It's designed to make it easy for people to find solutions to their problems without having to ask for help.

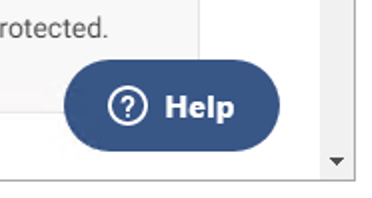

Register with HMRC for VAT, PAYE, UTR & more, all in 1 place

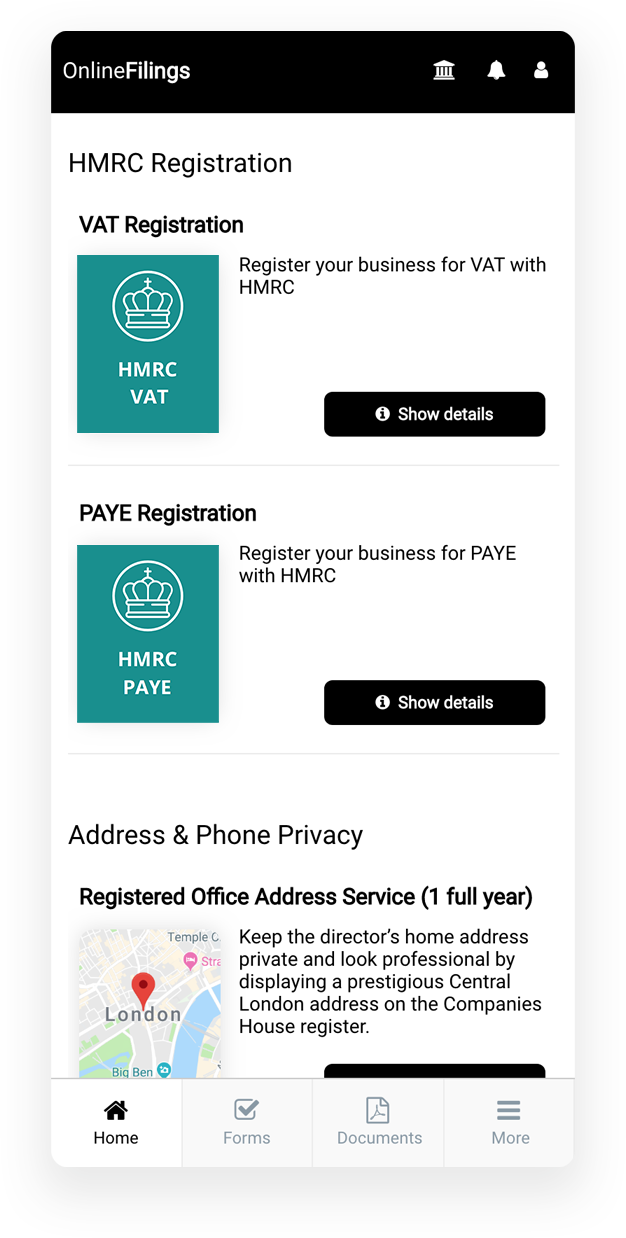

Our friendly customer

service team is

always 1 click away

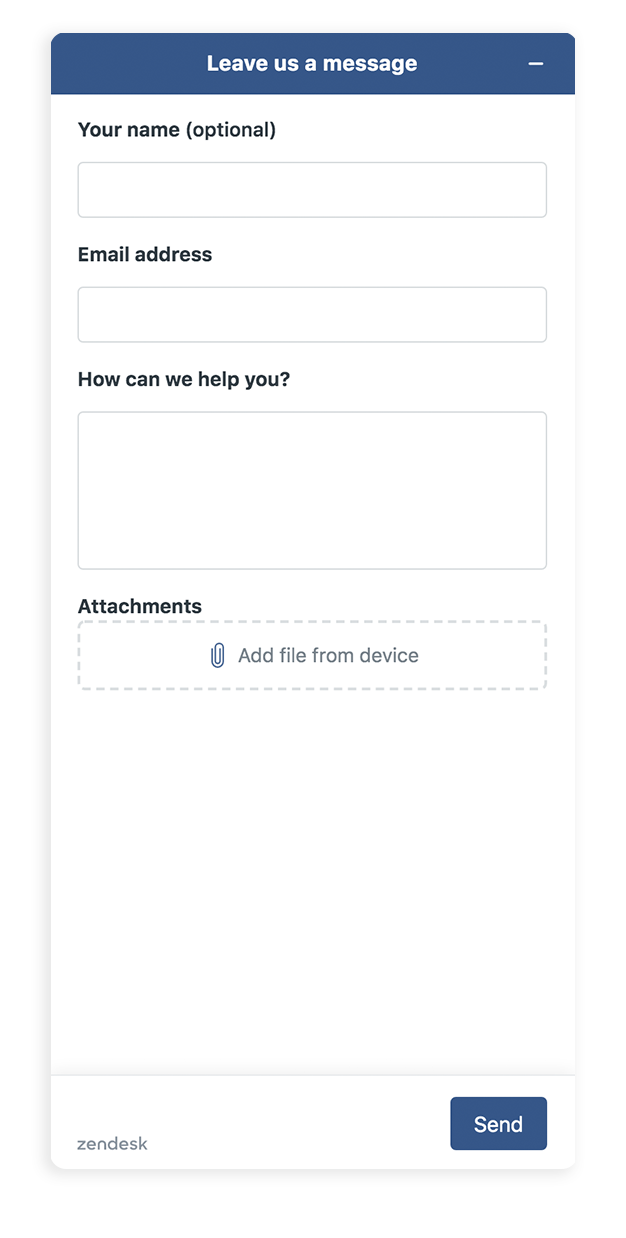

Take a picture of your passport or driving license as your proof of ID

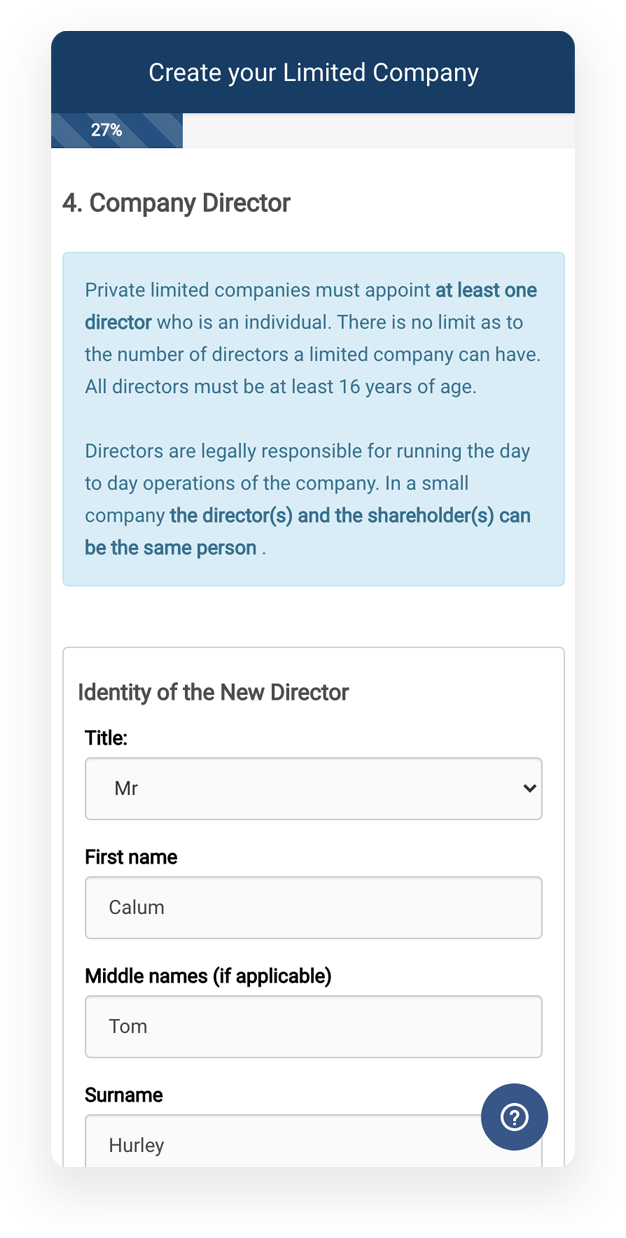

Our simplified forms are very user friendly, even on your mobile device

This website utilises technologies such as cookies to enable essential site functionality, as well as for analytics, personalization, and advertising purposes. Cookie Policy