By Dimitri - 26/01/2021

By Dimitri - 26/01/2021

Table of Contents

- Why It's Favored & Why Should You Register for VAT

- What Is VAT?

- How Is It Calculated?

- A Concrete Example of VAT Rates

- Why the VAT Is Not Favored

- VAT Problems

- Can You Get A VAT Refund?

- VAT Facts

- Run Your Company Online

Have you heard of Value Added Tax? Do you know how it works? Well, if you don't, you're in the right place.

In essence, VAT is a non-globally adopted tax system that promotes tax revenue and gross domestic product growth. However, it's not without downsides.

In this article, we will cover everything you need to know about VAT and how it works. So that you can make an educated decision if you're considering to register for VAT or pay VAT.

Whenever you're ready to learn about this tax system, keep reading and you will also find out how to perform VAT filing for refunds.

What Is VAT?

Value Added Tax or VAT was first implemented into the Indian tax system in 2005. This tax is a utilization tax ingrained on services or products throughout different stages of its life-cycle.

This is a point-oriented process of tax levying on value addition. The value is collected throughout the different stages of sale with a set-off for tax paid at the purchase tax stage.

Thus, it must be paid at each point in the transaction of buying and selling. But don't get confused with the earlier phrasing. There's a much easier way to explain VAT.

For instance, when a laundry machine is manufactured, it requires various parts and raw materials. To do this, the company must buy materials and parts from other suppliers. When the supplier sends the parts and materials, the manufacture will be charged VAT on all the supplies.

Once the laundry machine is assembled and reaches the store, the consumer who buys the item will pay the VAT that applies to them. From the point of the buyer, VAT is a purchase price tax. From the point of the seller, it's a tax on added value to the final product, service, or material received from distributors.

The manufacturer then remits the government the difference between the two VATs and keeps the rest to offset tax costs that they paid on previous value-additions.

Hence, VAT is an indirect tax paid to the government by the manufacturer, and the cost of covering this tax is passed on to the buyer. The consumer pays the final VAT.

The VAT charged on good purchases from a supplier by a manufacturer is an Input Tax, and the VAT charged on the sale is the Output Tax. The purchase prices will include the Input Tax at the time of purchase from suppliers. And the sale of goods will include the Output Tax collected at the point of sale to the consumer.

How Is It Calculated?

As you've gathered, VAT is calculated on the differences between Output and Input Tax.

The formula for this process would be:

VAT (Value Added Tax) = Output Tax - Input Tax

However, VAT is calculated in two primary methods. In the first, tax is charged on its own on the foundation of tax paid on purchase, as well as the tax payable on sale. Thus, the difference between the tax paid on purchase and payable sales tax is the VAT.

In the other method, tax is charged and collected on the aggregate tax payable value on purchase and sale. This is done by applying the VAT rate to the goods. Thus, the difference between the sales price and buying price is the VAT.

This means that VAT is the tax that consumers face at the end of the life-cycle, but that is collected at each stage.

A Concrete Example of VAT Rates

Let's take a look at a 10% VAT tax example that might occur through the entire production chain.

An electronic component manufacturer buys raw metals from a dealer. The dealer is the seller at this point. The dealer charges £1 and 10 cents of VAT tax, he sends the VAT to the government.

The manufacturers create the components with the raw metals, which then cells the components to a computer manufacturer for £2 and 20 cents of VAT. He sends 10 of the 20 cents to the government and keeps 10, which reimburses the VAT that was paid by the metal dealer.

The computer manufacture adds more value by making the computer, which it sells to a computer retailer for £3 and 30 cents of VAT. The company pays 10 cents to the government. The other 20 it gives to the computer manufacturers for the VAT they paid for the components.

The retailer sells the computer for £5 and 50 cents for VAT. 20 cents is paid to the government, and the rest is kept by them as reimbursement for the VAT they paid. The VAT paid at each point in the chain represents a 10% value addition by each seller.

In the U.K, the standard VAT is 20%. This rate is reduced to 5% on some products, such as home energy and car seats for kids. There is also no VAT on some items, such as kids' clothing or food. Property and financial transactions are exempt.

Why It's Favored & Why Should You Register for VAT

Those who are in favour of the VAT system argue that it prevents tax avoidance. The fact that VAT is recorded and charged at each point in the sales cycle, rewards tax compliance and disincentivizes black market operations.

For suppliers and manufacturers to be credited for VAT payments, they are responsible for VAT collection on their output, the goods they sell or create.

Retail businesses are incentivized to collect tax from consumers since that's the only way to obtain credit for VAT that they paid for buying products in the first place. Therefore, VAT registration is potential.

VAT is also a better alternative to hidden taxes. These taxes are those that consumers without transparency, such as alcohol or gasoline taxes. In the US, many surcharges are not itemized on top of sales tax.

Because they are levied with the same percentages as most services or products, VAT is seen as less impactful on individual economic choices. It can register on the country's economy either way.

VAT is an effective way to improve gross domestic product growth, eliminate budget deficits in the government and raise tax revenue.

Why the VAT Is Not Favored

The opponents of those who favour VAT present the idea that it burdens people with low incomes. Unlike a progressive income system, such as the US in which high-income people pay greater percentages, VAT is flat. All people pay the same percentage, regardless of their income.

Of course, the 20% VAT will cut deep into the budgets of those who make less money. To relieve this inequality, most countries having VAT, including the UK provide exemptions/discounts on necessities, such as groceries and kids' clothing.

Not to mention, VAT can be confusing for businesses. In those cases, a cash accounting scheme for VAT can help.

VAT Problems

VATS are regressive and the cost falls on the poor mostly. It's practically impossible to remove the HMRC and tax system in the UK, so VAT is going to be another additive tax imposed on the UK if continually used.

In the US, if VAT replaces state sales tax, the state will be weary. The state sales tax system is complicated with some states not charging sales tax and others using their own rates, including even more localized options.

VAT calculations can cost a lot to the business because VAT must be calculated on each product at each step in the life-cycle. These costs will be passed on to consumers, along with VAT rates.

Can You Get A VAT Refund?

If you visit a VAT country, you can potentially get a VAT return on the tax you paid when shopping. Keep in mind there are many steps to go through and some travellers will decide that the process is not worth it. Before you travel, ensure to check VAT rules in the country you're visiting.

Spending on hotels and food is not VAT refund eligible. You have to be a visitor to get a VAT refund, the address on passports matter. You qualify as a visitor if you live in a country temporarily but have a home elsewhere.

You have to pay VAT at the time of purchase, and then apply for the refund in the shop or online. Some shops do not offer refunds, some shops process them directly and some use third-party services. Ask for written instructions if applicable.

You need to show the store clerk proof that you don't live in the country, and you must fill out a form. In some cases, the shop will charge a fee for the refund, ask about this before.

Your purchase must be over a specific amount to qualify for the VAT refund. In the EU, you have to buy at least 175 Euros worth. This threshold is not cumulative, meaning spending 100 there and 100 here does not meet the requirements.

When you leave the country with your items, a customs officer must stamp the refund papers as export proof. Without this, you cannot get your refund.

You also need to mail your stamped VAT refund to the address that the shop provisions. You don't have to wait to get back home either. Some ports, airports, or stations have VAT refund offices where you can get the money right away if the retailer makes use of such offices.

VAT Facts

Here are some general VAT facts you might have not to know about. VAT is one of the largest sources of government revenue in the UK after the National Insurance and Income Tax. It generates over 120 billion pounds per year.

While this might mean that your products are more expensive to buy, there's little less revenue in that product aisle, it helps contribute towards the country running its services.

If you're one for cultural activities, the admission charges by cultural bodies or government authorities to some events, such as art expos, zoos and museum are VAT exempt.

Some of the greatest tax rebate cases in court have involved the understanding of differences between confectionery and cakes. Aside from the 2014 Jaffa Cakes case, two judges ruled that Snoballs Hostess were cakes after courtroom tasted them.

In a crucial sense, cakes unlike confectionery are exempt from VAT. The court ruled that Lees of Scotland and Tunnocks were free, and received several million pounds in VAT rebate. Furthermore, Pringle's manufacturers, Proctor and Gamble, claimed that the snack cannot be VAT classified, because the crisps only have 42% of potato.

Despite the case success, the court appeal overruled the decision the next year.

Do you fancy flutter on the footie or you want to buy a helicopter? Well, you'll be surprised that both are VAT exempt. Other vehicles in the 0% VAT category are some caravans, airships, houseboats, military planes, civil aeroplanes, ships over 15 tonnes.

Not to mention, lottery tickets, bingo and online casino games are free from VAT. Once again, keep in mind that VAT is country-specific, so you might never come across, to begin with, unless you're travelling.

However, many countries are adopting this VAT tax system, so it's not improbable for your country to consider the implementation of the system. It's very successful in the UK, which means most of the EU has already adopted it.

Run Your Company Online

Now that you know what the Value Added Tax is, as well as how it works, you are that much closer to making use of the VAT rate when the time comes. In any case, those who benefit the most from VAT are those who learn about it and those who calculate it accurately.

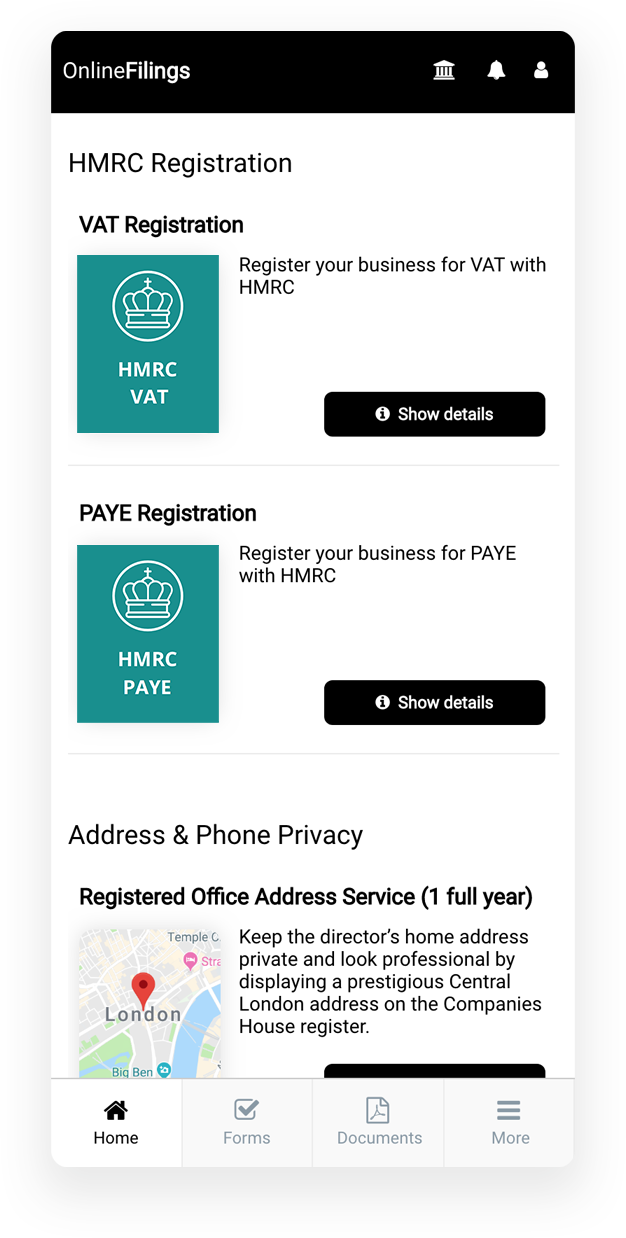

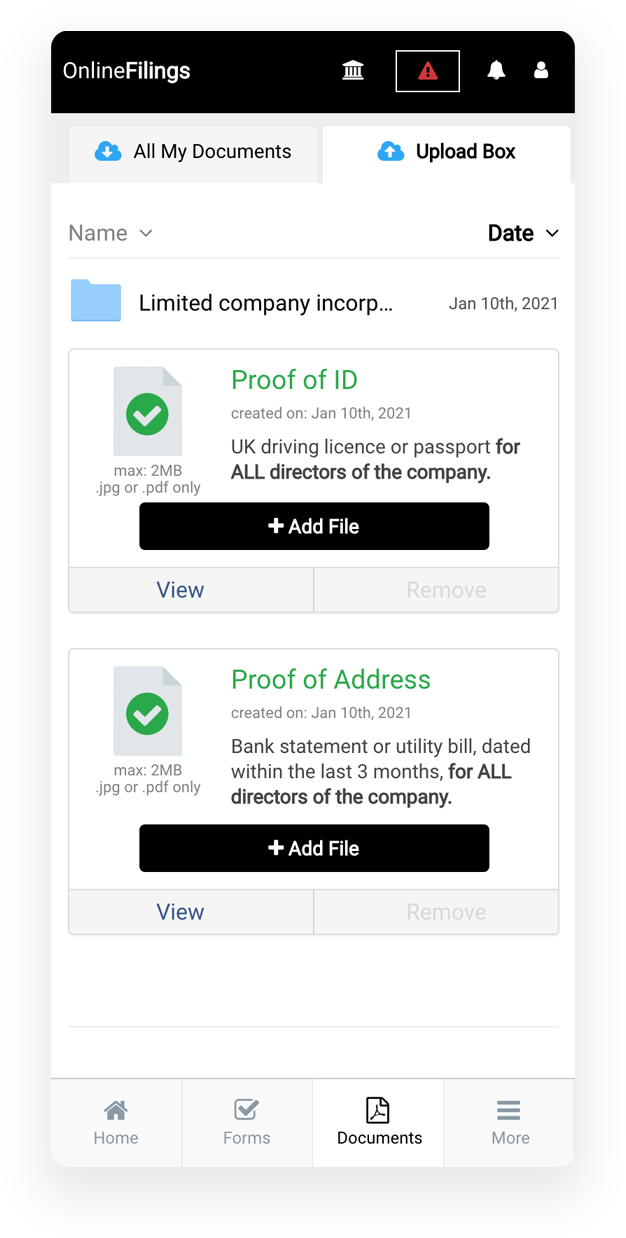

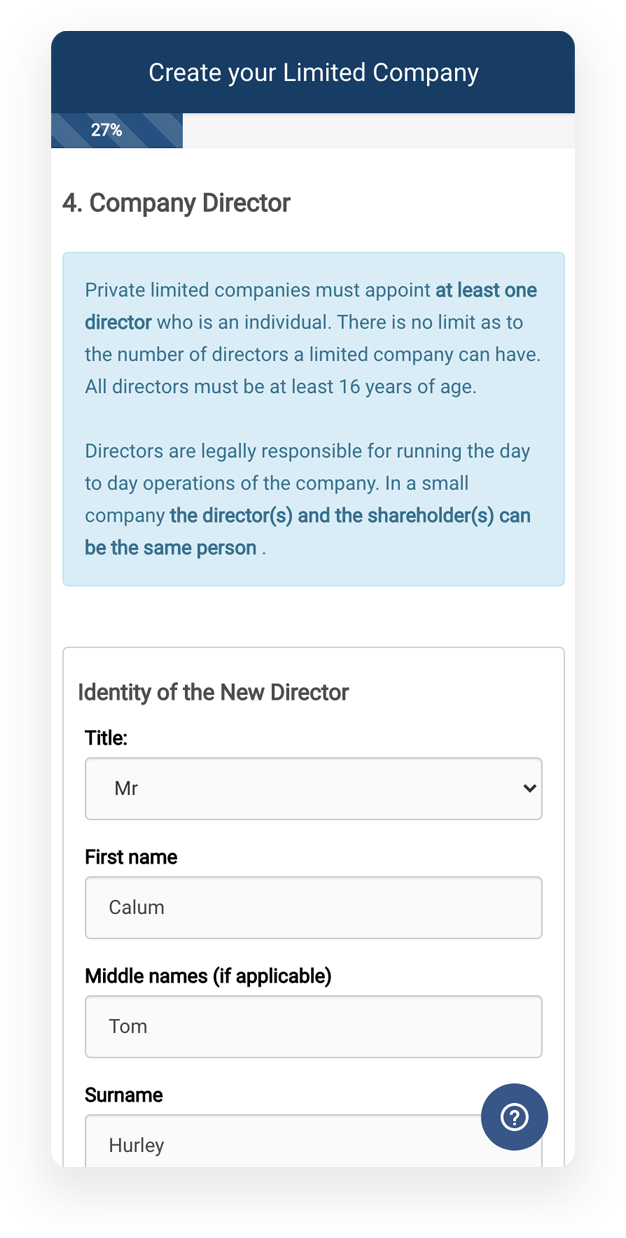

If want to register for VAT online, and discover methods of business management online, get in touch with us and we will help you run your business remotely.

By Dimitri - 26/01/2021

By Dimitri - 26/01/2021