By Kaity Cornellier - 04/05/2022

By Kaity Cornellier - 04/05/2022

Table of Contents

- What are dividends?

- Why pay yourself dividends instead of a salary?

- How do I pay myself dividends?

- How do I pay tax on dividends?

- Record-keeping

- In summary

If you’re a shareholder in a limited company, it’s important to find the best way to pay yourself in order to reduce tax and keep more of your income. The most common options are taking a salary and paying yourself dividends.

You’ve probably heard that dividends can be quite tax-efficient. However, to reap this benefit, you’ll need to understand how to pay dividends, how they are taxed and what HMRC requires of you. Once you have the essential information, paying yourself dividends couldn’t be easier.

Read on to find out everything you need to know before paying your first dividend.

What are dividends?

HMRC defines dividends as a “payment a company can make to shareholders if it has made a profit.” Dividends are taken from company net profits, which is the revenue after costs (wages, rent, etc) & tax liabilities (VAT, Corporation Tax, etc) have been deducted.

Only shareholders can receive dividends as a reward for their investment risk. They often receive dividends based on the number of shares they own, but this is not a requirement. For example, if your company has a total of £5,000 in dividends to pay and you own 20% of shares in the company, you would receive a dividend of £1,000.

There is no requirement to pay any or all profit as dividends, you can take dividends out any time you want. Any profit not taken as a dividend is re-invested into the company.

Why pay yourself dividends instead of a salary?

Paying yourself dividends can be more tax-efficient than taking a salary for two main reasons. Firstly, dividends accrue less tax than salaries. Below are the Income Tax bands for a salary:

Salary income tax bands and rates

Tax-Free Allowance | Basic rate | Higher rate | Additional rate | |

Income tax | 0% | 20% | 40% | 45% |

Threshold | £0-£12,570 | £12,570-£50,270 | £50,271-£150,000 | £150,001+ |

The amount of tax you pay on dividends depends on the tax band your total income puts you in. Comparatively, dividends are taxed at a much lower rate:

Dividend tax bands and rates

Tax-Free Allowance | Basic rate | Higher rate | Additional rate | |

Dividend tax | 0% | 8.75% | 33.75% | 39.3% |

Threshold | £0-£2,000 | £2,000-£37,700 | £37,701-£150,000 | £150,001+ |

Second, you won’t pay any National Insurance contributions (NICs) on dividends like you would with a salary. This can significantly reduce your tax bill. To illustrate this, let’s see how much tax Susan would pay on dividends compared to a salary.

Example 1: Tax on Dividends (for 2022/2023 tax year)

If Susan took £59,100 in dividends per annum as her only form of income, she would have £44,530 as taxable income after subtracting the £12,570 personal allowance and £2,000 dividend allowance.

She would pay the 8.75% basic rate tax band for her income from £14,570 to £37,700 which is £2,023.88.

She would then pay the 33.75% higher rate for the rest of her income, £37,700 to £44,530, which is £2,305.13.

In total, she would pay £4,329.01 in tax on her income from dividends

If Susan had taken the entire £59,100 as a salary, she would be taxed a bit differently.

Example 2: Tax on Salary (for 2022/2023 tax year)

If Susan paid herself a salary of £59,100 per annum, she would have £46,530 as taxable income after subtracting the £12,570 personal allowance.

This amount puts her in the 20% basic rate tax band, so she would pay £9,306 in income tax.

Her salary is above the threshold for Class 1 NICs that employees pay, so she would pay £5,023.40 in NICs.

Her total tax bill would be £14,329.40. Click here to find out more about calculating income tax and NICs on a salary.

Susan would save £10,000.39 on her tax bill if she took some or all of her income as dividends. The lower tax rate and additional allowance make dividends a tax-efficient option for shareholders to pay themselves.

To pay tax on the dividends you received, you will need to submit a self assessment tax return to HMRC. If you’re looking to pay your taxes to HMRC on the dividends you received, our Self Assessment filing software will calculate your full tax bill in minutes and submit it to HMRC. Click below to get started.CALCULATE YOUR TAX BILL

How do I pay myself dividends?

There is no limit or set amount you need to pay, but you must only be paying dividends from your previous year’s retained earnings and current year’s company profit. Retained earnings are the profit a company has left after paying its income tax, dividends and costs (salaries, production, etc). You can distribute dividends from retained earnings accrued in previous accounting periods as well as your current one.

You can pay shareholders different dividend amounts, but companies often distribute funds according to the percentage of shares each shareholder owns and the class of shares they own. It may be a good idea to leave some profit in your business to upgrade assets, invest in growth, and for other activities.

There are no rules about how frequently you should be paying dividends. Larger corporations normally distribute quarterly or every six months, but solo entrepreneurs and small and medium-sized enterprises (SMEs) may prefer monthly dividends for a more regular income.

HMRC requirements on how to pay dividends

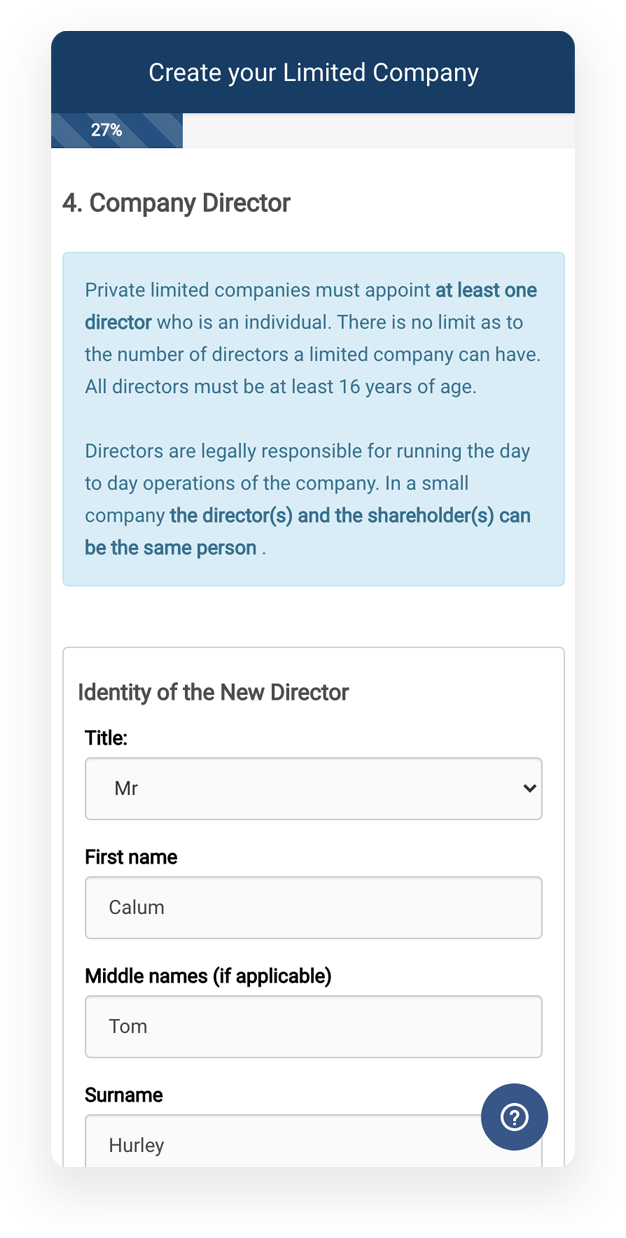

To pay out dividends, you’ll need to hold a board meeting and agree on a dividend declaration. Record the minutes of this meeting, even if you’re the only shareholder.

For each dividend your company makes, you must write up a dividend voucher with the date, company name, shareholders receiving a dividend, and the dividend amount. There’s no standard template for dividend vouchers, but it must include:

- Date

- Company name

- Name/address of the shareholder receiving

- Total number of shares owned

- Total dividend payable

- Director’s signature

Keep a copy of each voucher for your company’s records and give a copy to the recipient of each dividend payment by email, paper or generated by an accounting software package.

How do I pay tax on dividends?

Self Assessments

You will need to include dividend income on your Self Assessment tax return.

If you haven’t done a tax return before, you will need to register for a Personal UTR. Normally this process can be quite daunting, but with OnlineFilings, it couldn’t be easier. Registering takes 10 minutes, and we’ll submit your application in 24 hours, ensuring your UTR reaches you as soon as possible. Click below to get started.APPLY FOR UTRIf you don’t normally file a self-assessment and your dividend income is between £2,000 and 10,000, you should contact HMRC. They may adjust your tax code so your dividend tax is taken from your wages or pension. If your dividend income is below £2,000, you don’t need to notify HMRC.

Record-keeping

To file your Self Assessment smoothly, you should keep clear financial records of all dividend payments, including:

- All dividend vouchers

- Records of all charitable donations (through Gift Aid and not)

- Student loan repayments

- Pension contributions

You will need these for both your Corporation Tax return and personal self-assessment each year. Having these files on hand will make your self-assessments quicker, easier and more accurate.

In summary

Paying yourself dividends can be an excellent tax-saving option for shareholders. Be sensible in the way you take out dividends, abide by HMRC guidelines, and try to leave enough in the business for future investments and padding out less profitable years.

Lastly, keep organised records so you can report your dividend income to HMRC and file your Self Assessment. This becomes even easier when you use the OnlineFilings™ Self Assessment software.

Ready to get started?

By Kaity Cornellier - 04/05/2022

By Kaity Cornellier - 04/05/2022