By Kaity Cornellier - 05/05/2022

By Kaity Cornellier - 05/05/2022

Table of Contents

- Do I have to pay myself a salary as a director?

- What is PAYE and how do I register?

- How much tax do I pay on my salary?

- Example: How to Pay Yourself Optimally

Deciding how to pay yourself a salary can be complex for limited company directors. Should you pay the bare minimum and invest the rest in your business, or set a higher directors salary to remunerate yourself for your hard work?

There are many factors to consider like tax efficiency, your business model, your profits, your percentage of growth each quarter, and more. The goal is to maximise income, minimise tax & receive income in a way that works for you.

Here’s what you need to consider when paying yourself as a director.

Disclaimer: The purpose of this article is to provide an overview of your options and factors to consider and it should not be taken as advice. Every business is different so speak to an accountant to get personalised advice on what’s most tax-efficient in your unique situation.

Do I have to pay myself a salary as a director?

You don’t have to, but it’s certainly worth considering. There are 4 main benefits to paying yourself a salary:

- Reduced tax bill: You can claim your salary as an allowable expense so you’ll pay tax on a smaller amount of your profit, therefore reducing your Corporation Tax bill.

- Not profit-dependent: You can be salaried even if your business makes no profit.

- Fixed payments: You can pay yourself a weekly, monthly or annual salary, which can be beneficial for planning your personal finances.

- State pension: Salaries add qualifying years to your state pension, even if you’re self-employed, as long as it’s above the Lower Earnings Limit (more on that below).

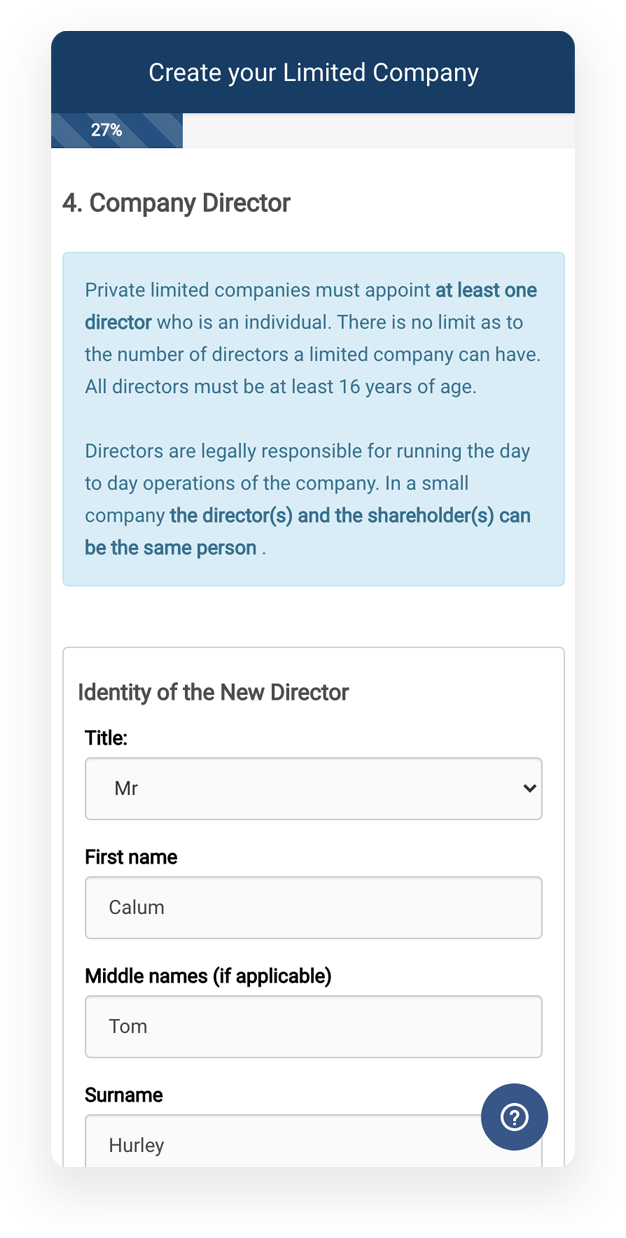

As a limited company director, you are entitled to pay yourself a fixed monthly salary using HMRC’s payroll system Pay-As-You-Earn (PAYE).

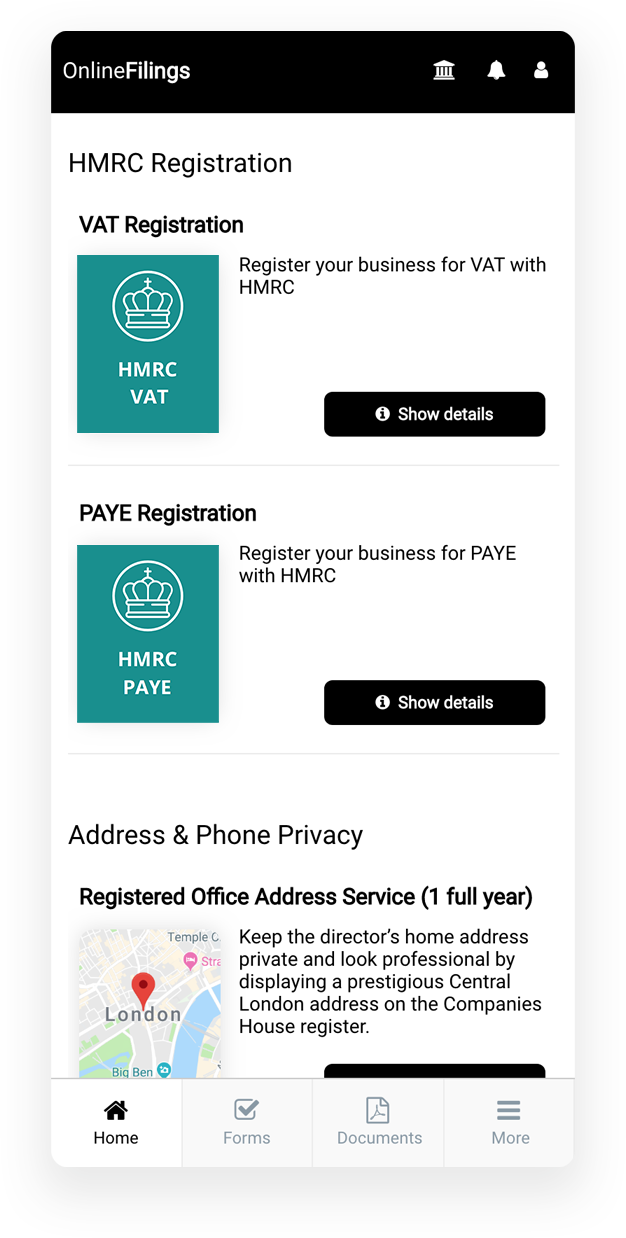

What is PAYE and how do I register?

PAYE is HMRC’s payroll system used to collect Income Tax and National Insurance contributions (NICs) from eligible employees. It uses Real-Time Information (RTI), where you will send reports to HMRC every time you pay an employee. This helps your business remain compliant and pay the correct amount of tax.

Under RTI, you will also send a year-end submission containing a summary of your PAYE information, including the dates and times you’ve paid each employee. These are due to HMRC by 19th April every tax year.

You’ll need to register as an employer with HMRC once you start employing staff, even if you’re just employing yourself. This includes if you are paying an employee at or above the National Insurance Lower Earnings Limit (£6,398 per year) and if you are only employing yourself.

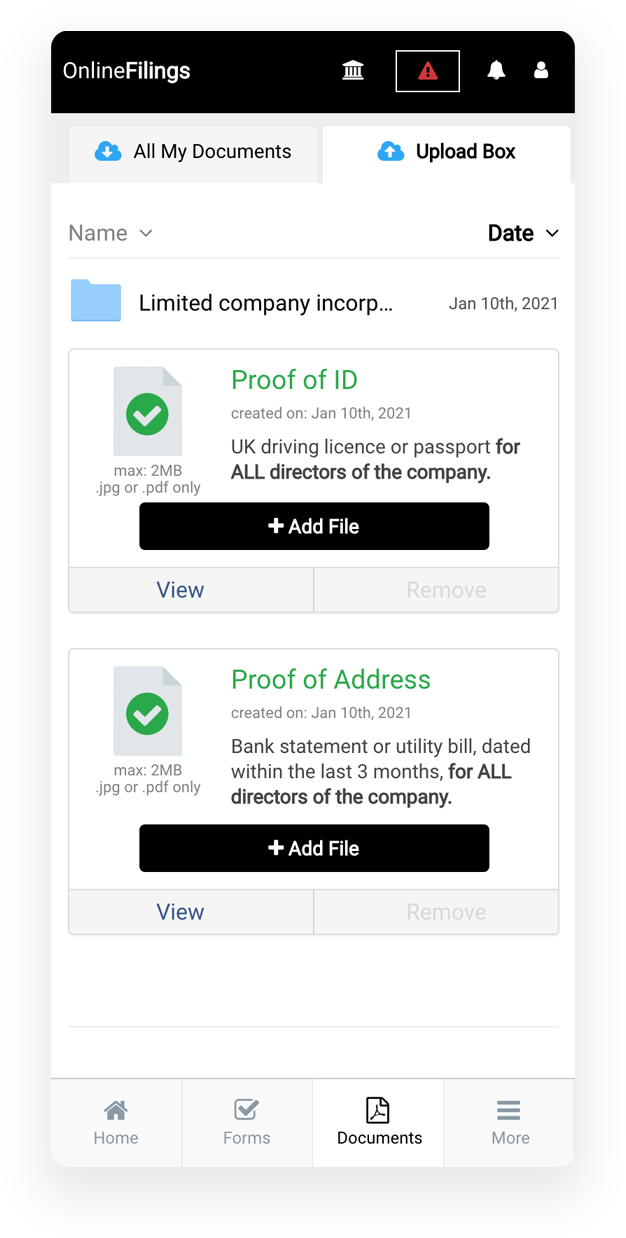

Before you register, you’ll need to have the following on hand:

- Your company number

- Authorising director’s name and NI number

- The number of employees you have or expect to employ

- The date of the first payday

Then you can register anytime up to 2 months before the first payday.

Shortly after you’ve registered, you’ll receive a PAYE reference and PAYE account number. If you want to simplify the registration process, click below to use our convenient PAYE registration software and we’ll sort the rest for you

How do I start running a payroll?

After registering for PAYE, you’ll need to choose how to set up & start running a payroll. There are 2 main options:

Use a payroll provider (like a bureau or an accountant)

Some providers only run payroll and provide payslips, while others can keep employee records and make payments to HMRC. Consider how much support you’ll need because if they only run payroll and issue payslips, you’ll be responsible for everything else.

Do it yourself using payroll software

If you choose this option, you’ll need to follow these steps:

- Choose your payroll software to record your employee’s details, calculate their pay and deductions, then report it to HMRC

- Collect and keep records of what you pay employees, deductions you make, reports & payments to HMRC, holidays, sick days, tax code notices, taxable expenses, benefits and any Payroll Giving Scheme documents

- Tell HMRC about your employees

- Report their pay and deductions to HMRC on or before the first payday in a Full Payment Submission (FPS)

- Pay HMRC the tax and National Insurance you owe

Running a payroll yourself can be cost-effective, but takes much more time than hiring a payroll provider. Make sure to assess the needs of your business to decide how to run your payroll.

Checklist: 5 tasks when employing your first employee

Before you employ your first worker, you’ll need to tick each of these off:

- Check they can legally work in the UK and perform any other necessary employment checks

- Check if they should apply for a DBS, particularly if they are working in security, with vulnerable people, or in another field that requires it

- Get employers' liability insurance as soon as you become an employer

- Send details of their job, including the terms & conditions, in writing to your employee - they will need an employment contract if they’ll be employed for more than 1 month

- Check if you need to automatically enrol your staff into a workplace pension scheme

Once you’ve registered for PAYE, put yourself on payroll, and started paying yourself a salary, the next step is to find out how you’ll be taxed.

How much tax do I pay on my salary?

The salary you take is subject to Income Tax, but the amount of tax you pay varies depending on how much you’ll be paying yourself as a director. You’ll pay a percentage of your total salary, depending on what tax band it falls into.

The rates are as follows:

Personal Allowance | Basic rate | Higher rate | Additional rate | |

Tax band | 0% | 20% | 40% | 45% |

Tax threshold | Up to £12,570 | £12,571 to £50,270 | £50,271 to £150,000 | £150,000+ |

Note: Your Personal Allowance will reduce if your salary is over £100,000. It gets reduced by £1 for every £2 above the threshold. You do not get a Personal Allowance if your salary is over £125,140.

If you pay yourself a salary above a certain threshold, you’ll also need to pay National Insurance contributions (NICs), which pertain to both employees and employers. If you’re paying yourself as a director, you must take both into consideration.

Below are the National Insurance contribution thresholds for the 2022/2023 tax year:

Class 1 (paid by employees) | Primary Threshold | Upper Earnings Limit | Above Upper Earnings Limit |

Employee salary per annum | Up to £9,880 | £9,880 - £50,270 | Over £50,270 |

NI Contributions | 0% | 12% | 2% |

Secondary class 1, 1A & 1B (paid by employers) | Secondary Threshold | Above Secondary Threshold |

Salary paid to employees by employer per annum (including directors) | Up to £9,100 | Over £9,101+ |

NI Contributions | 0% | 13.8% |

If you’re self-employed, you may also need to pay Class 2 National Insurance if your annual profits are £6,725 or more, and Class 4 National Insurance if your annual profits are £9,881 or more. If your profits exceed one or both of these thresholds, you’ll need to pay:

Rate for the 2022/23 tax year | |

Class 2 (paid by self-employed) | £3.15 per week |

Class 4 (paid by self-employed) | 10.25% (for profits of £9,881 - £50,270) 3.25% (for profits of £50,271+) |

You should also consider the Lower Earnings Limit (LEL). If your salary is over £6,396 per annum (in the 2022/2023 tax year), you qualify for state benefits like State Pension.

Keep all of these thresholds in mind. The Primary Threshold, Class 2 & 4 NICs and Lower Earnings Limit are relevant for your personal tax bill.

Example

Example: Let’s say Joe earns a salary of £56,570 per annum (£4,714.17 per month). In the 2022/23 tax year, how would he be taxed?

Because of his Personal Allowance, he would not pay any income tax on the first £12,570 earned.

He would then pay 20% basic rate tax on his income from £12,571 to £50,270, which comes to £7,540.

He pays 40% higher rate tax on the rest of his income, from £50,271 to £56,570, which adds another £2,520 to his tax bill.

→ He pays a total of £10,060.00 in Income Tax.

Because he is an employee with a salary is above the £9,880 Class 1 National Insurance contribution threshold, he’ll pay 12% tax on his earnings from £9,881 to £50,270, which is £4,846.80. He pays an additional 2% above the Upper Earnings Limit (£50,271 to £56,570) adding £126 to his tax bill.

→ He pays a total of £4,972.80 in NICs.

His annual tax bill, including Income Tax and NICs, is £15,032.80. That means he takes home £41,537.20 per annum, or £3,461.43 per month.

As an employee, can I reduce the tax I pay on the salary I received?

There are ways to decrease your income tax bill by claiming other tax-free allowances that you can set against your Income Tax. For example, if you’re married you can claim Marriage Allowance (£1,260) and if you are legally blind, you can claim Blind Person’s Allowance (£2,600). Discuss with your accountant to see what allowances are available to you.

As an employer, can I reduce the tax I pay on my employee's salary?

If you have multiple employees you may be able to claim Employers Allowance. This was created as an incentive for small businesses to hire employees by reducing the amount of National Insurance contributions (NICs) they pay.

This allowance offers £4,000 in tax relief (2022/23) for companies with multiple employees who pay NICs. You cannot claim this allowance if you only have one employee paid above the £9,100 Secondary Threshold and that employee is the director.

Example: How to Pay Yourself Optimally

The most tax-efficient director's salary for the 2022/2023 tax year is £9,100 per annum (£758 per month). This is for the following reasons:

- No income tax: This salary is below the £12,570 personal allowance, so it doesn’t accrue any income tax. You can use the rest of the allowance (£3,470) against other forms of income, like dividends.

- Not subject to NMW: Usually, the National Minimum Wage (NMW) requires people to be paid more than this, but ‘office holders’ (people at a company without a contract) aren’t subject to these regulations.

- Below Primary Threshold: This salary is below the primary threshold (£9,880), so it doesn’t accrue any Class 1 Employee NICs.

- Below Secondary Threshold: It also doesn’t exceed the secondary threshold (£9,100), so you won’t pay any Class 1 Employer NICs.

- Above LEL: This salary is over the Lower Earnings Limit (£6,136) so you qualify for State Pension.

This director's salary does not accrue any PAYE tax (Income tax, Employer NICs and Employee NICs), making it a very tax-efficient option. You could then take the rest of your income as dividends, which are profits that a company can pay to shareholders. They accrue less tax than a salary does and give you an additional £2,000 tax-free dividend allowance as well.

Note that if you take a lower salary, you could face lower rates of acceptance for loans & mortgages.

Disclaimer: This is non-advisory. Consult your accountant for the best way to pay yourself for your business.

Deciding your director's salary

When deciding the salary to pay yourself as a director, there are lots of factors to consider. You’ll need to register for PAYE, set up your payroll and understand how salaries are taxed in order to decide the best option for you.

The registration process can be complicated, so let us do the hard work for you. Register for PAYE using the convenient OnlineFilings software-as-a-service platform. Our simplified application process saves you time and energy, getting your PAYE reference number to you in just days. Click below to get started.

By Kaity Cornellier - 05/05/2022

By Kaity Cornellier - 05/05/2022