By Kaity Cornellier - 28/03/2022

By Kaity Cornellier - 28/03/2022

Table of Contents

- Is it better to operate as a sole trader or as a limited company?

- Limited company: Key advantages and drawbacks

- What filing responsibilities do limited companies have?

- Sole traders: Key advantages and drawbacks

- How to switch from sole trader to a limited company

Thinking of setting up a business? Not sure if you should register as a sole trader or incorporate a limited company? There are several factors to consider before you decide. These include your legal responsibilities, tax efficiency, the amount of paperwork, and more.

Everyone’s situation is different, but understanding the basics of both structures can give you an idea of what’s best for you. Please note that the information in this article is non-advisory and should be used for reference only.

Is it better to operate as a sole trader or as a limited company?

The answer is entirely dependent on your situation. As a sole trader, you are your business. You have personal unlimited liability, so your personal assets, like your house or car, could be at risk when settling business debts.

A limited company, by contrast, is a separate legal entity from its owners (also called shareholders). They have a capped liability for all legal claims, losses and debts incurred by the business. Their liability is limited to the number of shares they have paid for, including any partly paid or nil shares they’ve yet to pay for.

For this reason, business owners can take calculated risks on business decisions without putting their personal assets in jeopardy. Limiting one’s liability can be an incentive for entrepreneurs, especially if they sell high-value supplies or operate services that could lead to liability claims.

It is worth noting however that in cases of fraud, directors' personal liability becomes unlimited.

At a glance

Limited company | Sole trader | |

1. Be your own boss | ✓ | ✓ |

2. Business is a separate legal entity | ✓ | ✗ |

3. Increased credibility | ✓ | ✗ |

4. Personal information kept private | ✗ | ✓ |

5. Easier to raise capital or get loans | ✓ | ✗ |

Limited company | Sole trader | |

1. Be your own boss | ✓ | ✓ |

2. Business is a separate legal entity | ✓ | ✗ |

3. Increased credibility | ✓ | ✗ |

4. Personal information kept private | ✗ | ✓ |

5. Easier to raise capital or get loans | ✓ | ✗ |

6. Pays Corporation Tax | ✓ | ✗ |

7. Pays Income Tax | ✓ | ✓ |

8. Files annual accounts | ✓ | ✗ |

9. Files Self Assessments | ✓ | ✓ |

10. Files Corporation tax returns | ✓ | ✗ |

11. Files Confirmation Statements | ✓ | ✗ |

As you can see, you will need to register for a Unique Tax Reference number (UTR) and submit a Self Assessment Tax return in both business structures. Sole traders file this as their only tax return. Each limited company owner must also file their personal Self Assessment, and in addition, the limited company must file a Corporation tax return.

Let’s examine each option more closely.

Limited company: Key advantages and drawbacks

To determine the pros and cons of setting up a limited company, we must first define what a limited company is.

A limited company is a company that is either ‘limited by shares’ or ‘limited by guarantee'. The company finances are separate from the owners' personal finances, and owners can keep all post-tax profit. Limited companies by shares have shareholders (owner of shares in a company), that are legally separate from the business.

Limited by guarantees companies are controlled by guarantors. This is the preferred option of non-profits whose shareholders do not take a share of the trading profits.

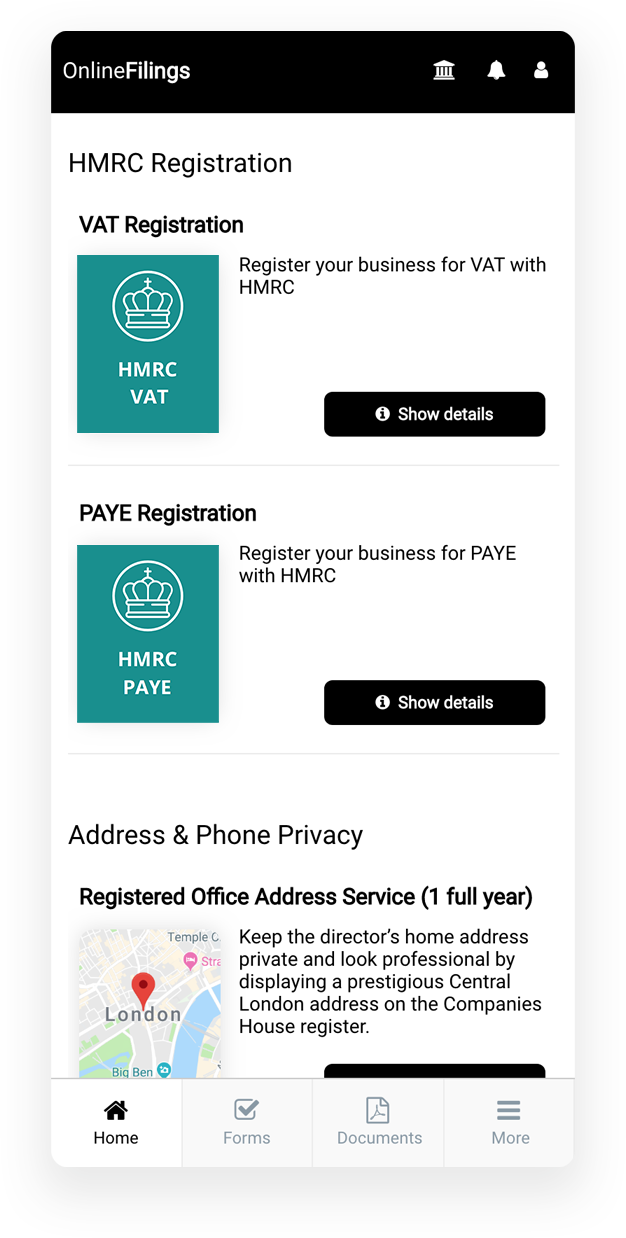

If setting up a limited company is right for you, incorporate in one business day with our Companies House-authorised filing software at OnlineFilings™. Receive your company registration number and incorporation documents to start trading in hours.INCORPORATE NOWRunning a limited company comes with certain filing responsibilities.

What filing responsibilities do limited companies have?

Limited companies must file the following at Companies House every year:

- Confirmation Statements: A document confirming that your company information on the Companies House register is correct. These are due 12 months after your incorporation date, and every year after.

- Annual Accounts: A comprehensive report of your company’s financial activity throughout the tax year. Your first annual accounts are due 21 months after your incorporation date, then 9 months after the end of every financial year.

While there can be more paperwork with a limited liability company vs. sole traders, there are some distinct advantages as well.

6 Advantages of Limited Companies

1. Limited liability protection from business losses or debts:

- Directors and shareholders hold limited liability if the company incurs any losses or debts, so their personal assets are protected. For example, a shareholder’s house cannot be seized to cover losses from the company. The company is a separate legal entity and the shareholder’s liability is limited only to the value of their share.

2. You have more options to pay yourself tax-efficiently

- Directors also have more flexibility in paying themselves which can be more tax-efficient. While sole traders pay 20-45% in income tax, limited companies only pay 19% in Corporation tax, often resulting in less tax to pay. Shareholders can also pay themselves dividends in addition to any salary they take.

- The freedom to choose what salary and dividends to pay yourself allows you to select the option with the least tax to pay. For example, a minimal salary allows directors to keep certain state benefits without paying any National Insurance contributions (NICs). They can receive the rest of their remuneration in dividends which incurs less tax and no NICs. Note that you will pay Corporation tax on dividends, however.

- Limited companies can claim a wider range of allowable expenses, reliefs and tax-deductible costs to offset their profits. Less taxable profit creates a smaller tax bill. If there is any leftover profit in the business, this can also be retained to fund growth or deferred for a later tax year. The latter is especially helpful if an increased income will push you into a higher tax bracket.

3. You are more likely to have a business loan application accepted, attract investment and raise capital.

- Limited companies can raise capital whenever they like by issuing new shares, unlike sole traders who must raise capital from their own resources. New shares are available both to existing shareholders and new investors. Limited by shares companies can effectively exchange shares for capital investment

- Companies can also create new share classes to offer more flexibility with shares. New share classes allow investors more control of the company by influencing voting rights, dividends, extracting capital and more. You may include pre-emption rights to protect the interest of your existing shareholders while establishing the company to make it easier to introduce new shareholders.

- Limited companies can often secure lower interest rates than sole traders and may be able to obtain loans without a director’s personal guarantee. Sole traders, however, may risk a charge on their private residence to receive a loan.

4. Limited companies can receive SEIS funds and other tax-optimised investments

- Limited companies can even benefit from tax-advantages schemes specifically for companies raising capital through shares. These include the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), plus you may be able to receive grant funding as a limited company.

5. More professional credibility and improved status because they are viewed as more established operations, so you appeal to a broader range of potential clients

- Incorporating a company with Companies House suggests that the business is permanent, stable and responsibly managed. This gives both customers and suppliers a sense of confidence in the business.

- The limited company structure can give companies access to a broader range of potential clients, particularly to bigger corporations that only work with other limited companies. Even though limited companies accrue more costs from the extra accounting and reporting, the increased opportunities usually make it worth it. This can make it easier to grow your company compared to other business structures.

- Limited company names also have to be unique, adding to their distinction. From the moment you register a company with Companies House, there can only be one active UK company with your name. It is fully protected and no other company can have the same name or anything too similar.

6. Perpetual existence (exists beyond the involvement of original owners)

- Limited companies have ‘perpetual existence’, meaning the company can exist beyond the involvement of its original owners. This means it’s easier to leave the business with a clean break compared to other business structures.

Please note that this information is for reference only and not advice. You should always seek professional advice for your specific situation.SET UP YOUR LIMITED COMPANY NOW

When considering the differences between sole traders and limited company directors, there are some drawbacks as well.

7 Drawbacks of Limited Companies

There can be some disadvantages to registering a limited company:

- Limited companies can cost more to operate: accountants, lawyers, a registered office address, insurance, and more that a sole trader doesn’t necessarily need

- You must pay Corporation Tax on all profits with no Personal Allowance

- You cannot remove money from the company whenever you please, must pay yourself a salary and/or dividends following strict procedures

- Directors pay both employer and employee National Insurance contributions (NICs) on their salary

- Accounting can be more time consuming and complicated so you are more likely to need an accountant

- More paperwork to file: Corporation Tax return, confirmation statement, annual accounts

- Your company information (address, directors/shareholders/PSCs details, filing history, financial activity) is made public on the Companies House register. You'll need to consider subscribing to a registered office address service to protect your home address privacy.

All this in mind, incorporating a limited company can be quite advantageous for some entrepreneurs. Others may benefit from registering as sole traders instead.

Sole traders: Key advantages and drawbacks

First things first, let’s define the term ‘sole trader’.

Sole traders are self-employed, owning and running their business as an individual. Their business is not a separate legal entity from them. For this reason, they have absolute control over their business, assets and post-tax profits. This business structure can be simpler and more versatile compared to others.

Sole traders are trading a technical or specific skill for money. They often consist of tradespeople providing services to individuals and families, like roofers, plumbers, hairdressers, plasterers, or decorators. You may also see smaller shops, manufacturers, self-employed consultants and internet entrepreneurs as sole traders as well.

Sole traders are personally liable for their business’s debts, so their personal assets could be at risk if they cannot settle the debt in another way. This unlimited liability and responsibility can prove challenging for some sole traders.

Like other business structures, sole traders must report and pay taxes to HMRC. They can employ staff and trade under a name that’s not their own (while following the same requirements as other businesses). Although sole traders ‘are their business', it’s important they manage things like finances separately from their personal affairs.

Unlike other structures, sole traders are not required to register with Companies House or file anything with them on an ongoing basis. Sole trader businesses have no directors or partners, nor do they have shareholders to invest capital. Their funding is limited to what they can raise personally.

How do sole traders pay themselves?

Sole traders do not pay themselves a wage or salary like the owner of a limited company would. They instead take ‘drawings’ out of their business profits to pay themselves. Profit made by the business is 100% theirs, and they are personally liable to pay National Insurance and Income Tax on this profit. Many sole traders open a business bank account so their personal finances are kept separate from the business.

It is important to keep records of every drawing you take as a sole trader. Keep your upcoming business costs in mind as well. It’s generally good practice to set aside some profit for:

- Your tax bill (25% per month should be more than enough to cover it)

- Quarterly VAT payments (if you’re registered for VAT)

- Any upcoming business expenditure

This can help you manage your business finances and record keeping.

How to register as a sole trader

If you’re earning most or all of your income through self-employment, you will likely need to register as a sole trader. It’s simple and free to do, so there’s no reason to put it off if you meet the criteria or think you will soon.

The criteria to register includes:

- Earning more than £1,000 from self employment in a tax year (6th April to 5th April)

- Needing proof of your self-employment (for example, to prove your employment status in a loan application)

- Wanting to qualify for state pension and other benefits by paying National Insurance contributions

If any of these describe you, then you have until 5 October of your second business year to register. For example, if you start trading on 19 October 2020, your deadline is 5 October 2021. Missing this deadline could result in a fine.

HMRC can fine you 30-100% of the tax you owe, depending on whether they believe you deliberately missed the deadline. They can also choose to charge you interest on your tax bill and add daily penalties. Although if it’s an honest mistake, you can avoid a fine by notifying them immediately. Let them know right away if:

- You have a reasonable excuse for missing the deadline, like an event outside of your control that prohibited you from registering

- Your reasonable excuse ended and you still haven’t registered

- You did not know you should register, so missing the deadline was not deliberate

Be honest with HMRC and own up to your mistakes. Hoping they don’t notice could make the situation worse.

Think being a sole trader is right for you? Register with HMRC using the OnlineFilings filing platform. Reserve your company name and get your Unique Tax Reference (UTR) number sent straight to your home. Pricing starts at £39.99.REGISTER AS A SOLE TRADER

8 Advantages of Being a Sole Trader

- You have full ownership & control of business

- All post-tax profit belongs to you

- Usually inexpensive to launch

- Minimal accounting and filing requirements (compared to limited companies)

- It’s possible to do your own accounting, which reduces accounting costs

- £1,000 trading allowance available if your expenses aren’t high and you want to reduce record-keeping

- None of your personal or business information is on public record

- It’s easy to register as a sole trader, and you only need a few pieces of personal information like your home address and National Insurance number

6 Drawbacks of Being a Sole Trader

- No distinction between you & the business, including finances & assets (although the right insurance can protect you)

- Unlimited liability for all debts and claims

- Can only take drawings to pay yourself which can be less tax-efficient than paying a salary and dividends, or other options available in a limited company

- More challenging to raise capital and get loans

- Less credible: larger companies and lenders prefer working with incorporated businesses, not sole traders (however, registering for VAT can help as it may indicate that your business is large, given that the threshold to register is a minimum revenue of £85K per annum)

- Can’t always meet the criteria for statutory sick pay (SSP) or maternity pay

The sole trader vs. limited company tax filings and legal responsibilities can differ quite a bit. Often, entrepreneurs will start out as sole traders and incorporate as a limited company after their business has grown. This is easy to do with OnlineFilings™.

How to switch from sole trader to a limited company

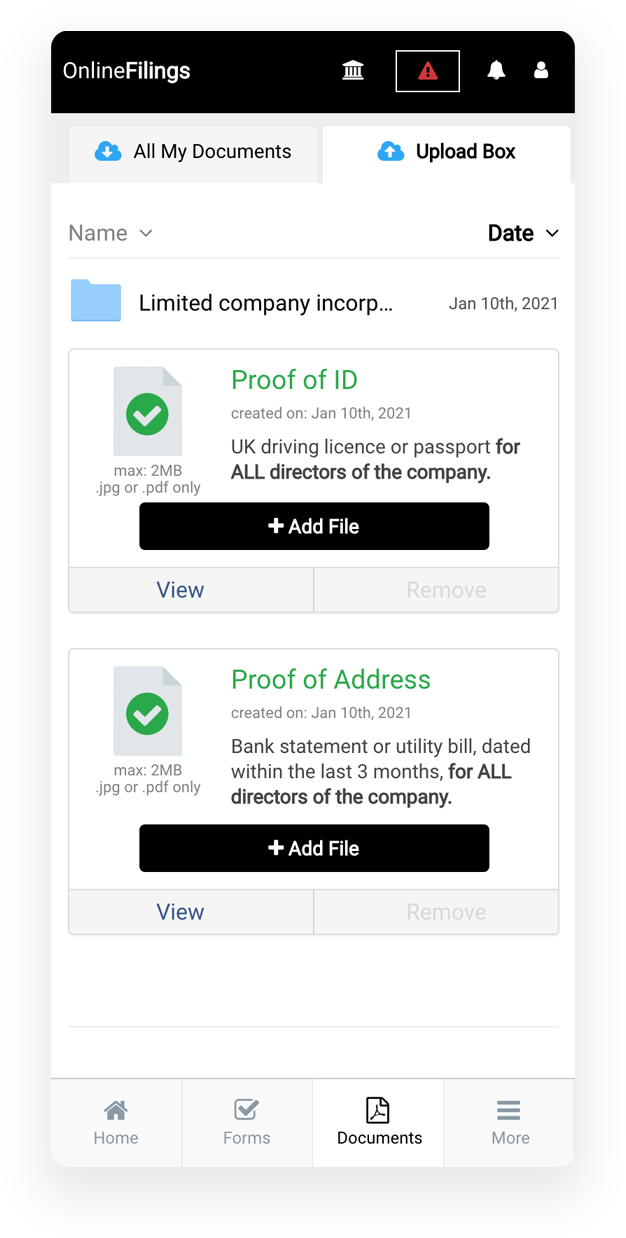

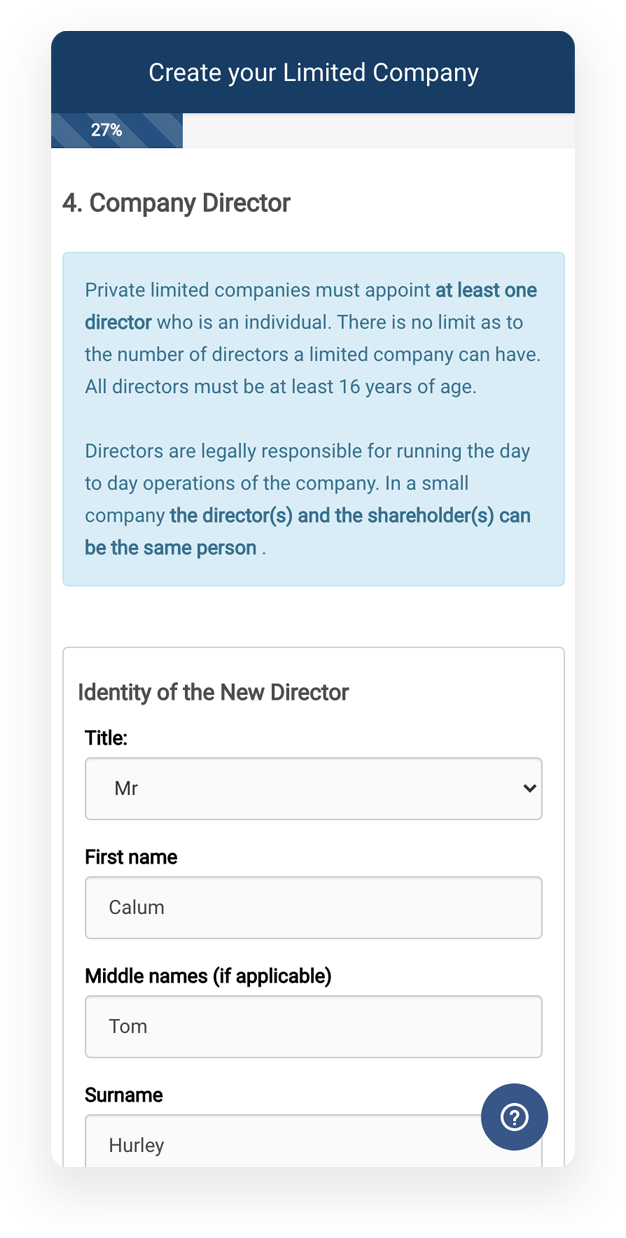

If the difference between sole traders and limited companies has inspired you to incorporate your limited company, look no further. Get incorporated in one business day using the Companies House-authorised OnlineFilings™ software as a service filing platform. You can do this in three simple steps:

- Check the availability of your company name

- Choose the company formation package that’s right for you

- Fill out our simplified application. Make sure you have the following information on hand:

- Company name

- Registered office address

- Director’s details (at least one)

- Shareholders/guarantors details (at least one)

- People with significant control (PSCs) information

- Service addresses for all directors, the company secretary, subscribers and PSCs

- SIC code(s)

- Details of issues shared (if applicable)

All OnlineFilings™ applications are submitted directly to Companies House. Once approved, you can start trading immediately and all incorporation documents will be readily available in your account dashboard.

Ready to get started?

By Kaity Cornellier - 28/03/2022

By Kaity Cornellier - 28/03/2022